Executive Summary

While it is normal to have rallies during bear markets, volatility caused by options trading currently appears to be having a more profound effect. Options give the purchaser the right to buy or sell an underlying stock at a specific price. The use of shorter-term options has been significantly increasing (see second graph). What happens behind the scenes is a high volume of hedging (buying and/or selling) by market makers. Specifically, zero days to expiration (0dte) options create more intraday volatility and thus more risk in the market. This type of trading is not investment, but rather pure gambling.

Please continue to The Details for more of my analysis.

“Gambling operates under the premise that greed can be satisfied by luck.”

–Rita Mae Brown

The Details

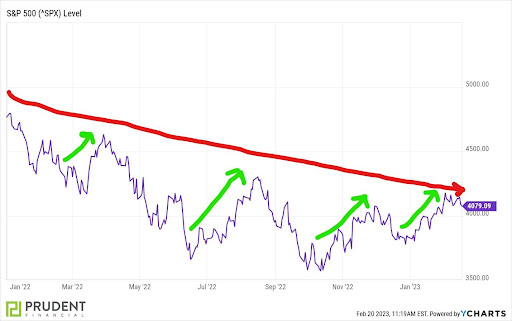

During bear markets, it is normal for there to be numerous rallies. Some of these rallies are very short-lived and rise only a few percentage points. However, others tend to pull in more speculators who believe the bear market has ended and a new bull market has started. FOMO or fear of missing out begins to draw more retail investors who do not understand how bear market cycles play out.

Although current bear market rallies are consistent with past bear market cycles, what is different is what instigates these rallies. The commonality is the existence of FOMO. Often it is a return to the stocks which led to the prior bubble. Believing these stocks – frequently technology stocks – can’t go down any more, leads to a “buy-the-dip” frenzy in these securities. This then spreads to other sectors.

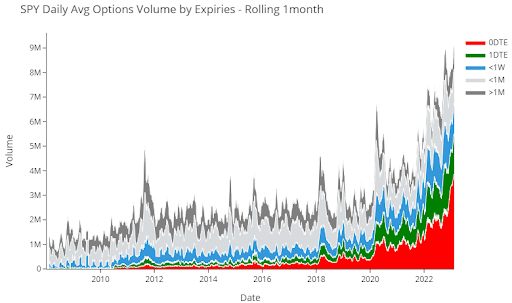

In recent rallies, speculators have transitioned to using a vehicle in such a manner it is nothing more than pure gambling. And that is the use of 0dte or zero days to expiration option contracts. Option contracts allow the purchaser the right to either buy or sell a stock or index at a particular price. Historically, investors would purchase options if they expected the price to rise or fall over a certain time frame. Knowing that no one can predict short-term movements in stock prices, investors might purchase options that mature months into the future. However, today, the number of option contracts purchased within a day of expiration has skyrocketed. Notice the extreme jump in short-dated options in the chart below via Markets & Mayhem on Twitter.

Each option contract controls 100 shares; therefore, the share volume resulting from these actions is astounding. And it is important to understand that the large fluctuations in price experienced on certain days can come from option market makers hedging their positions. With enormous numbers of short-dated options being purchased by speculators, one can imagine the hedging going on behind the scenes. This can be seen through wild market swings in very short periods of time.

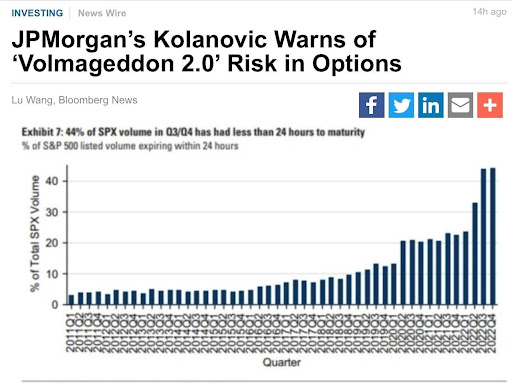

Notice in the chart below, the massive surge in S&P 500 option contracts with less than 24 hours to maturity. This type of activity is new and is causing tremendous volatility and creating additional risk in markets.

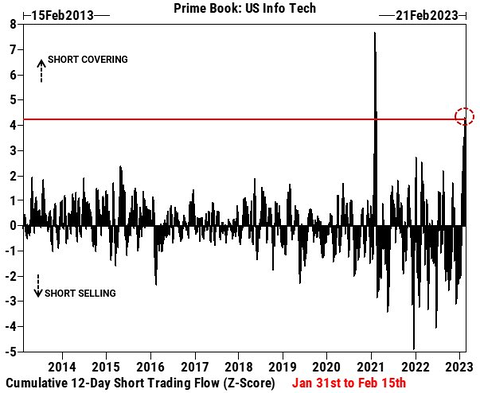

Another contributor to the swift moving bear market rallies is the existence of program or algorithmic trades. These trades can cause large shifts in positions from long (holding stocks) to short (selling stocks short) in very short periods. The last bear market rally combined extreme 0dte option purchases with massive “short covering” rallies. When the market rises quickly and there are a large amount of investors “short” the market, they often are forced to purchase stocks to cover their short positions. This purchase activity then forces more short sellers to cover. The snowball effect is a swift rally in stocks. Notice the dramatic surge in recent short covering in the graph below.

As is evident in the charts above, speculation in the markets is rampant. In an environment where fourth quarter S&P 500 net earnings have fallen 29% versus the prior year, stock prices remain tremendously overvalued, interest rates are high and rising, inflation persists, and the economy is slowing, market risk is rising. Many of the market gamblers will suffer as stock prices reconnect with underlying fundamentals. The gap to reasonable valuations remains wide.

The fad of the day, 0dte options, is gambling in its purist form.

The S&P 500 Index closed at 4,079, down 0.3% for the week. The yield on the 10-year Treasury Note rose to 3.82%. Oil prices decreased to $77 per barrel, and the national average price of gasoline according to AAA fell to $3.41 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.