Executive Summary

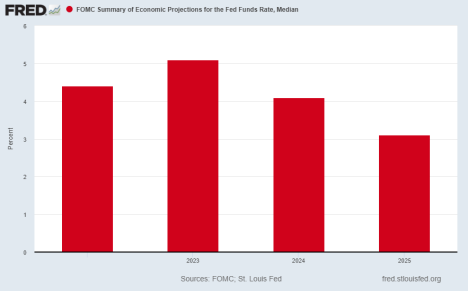

Last week’s Update discussed what could fuel a Santa Claus rally. While the CPI data provided some fuel, Jerome Powell threw cold water extinguishing the hopes for a rally. The slightly cooler CPI data resulted in hope for a Fed policy pivot and a market move higher. However, the next day Powell was hawkish (summary of his statement included below). It appears Fed tightening policy will continue. The last graph shows the revised FFR for 2023 now peaking around 5.1% and reducing through 2025 to 3.1%.

Wishing readers of these Weekly Market Updates a Merry Christmas and Happy New Year!

“An investment in knowledge pays the best interest.”

–Benjamin Franklin

The Details

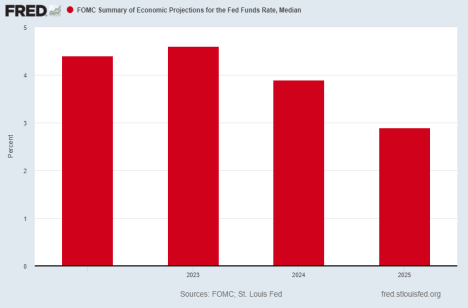

Prior to the Fed’s FOMC (Federal Open Markets Committee) meeting last Wednesday, the projections for the “terminal” median Fed Funds Rate – or the level where the Fed will stop hiking rates – was 4.6% in 2023. The rate was then expected to be reduced to just below 3% by 2025. As discussed in last week’s newsletter, investors’ hopes for a Santa Claus rally were based upon a faster “pivot” to rate reductions leading to a lower terminal rate. This sentiment by speculators has been behind most of this year’s bear market rallies. The graph below shows the rate projections before the last FOMC meeting.

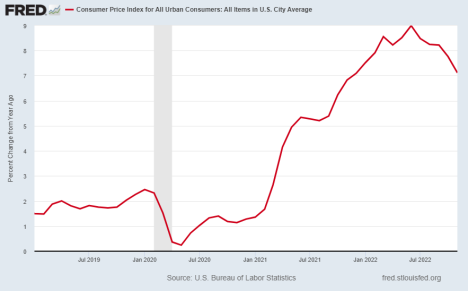

Last Tuesday, December 13, the latest CPI (Consumer Price Index) reading showed a reduction in the rate of change in inflation to 7.1%. This was slightly lower than “expected” and fueled more hopeful speculation that the Fed would return to more dovish talk at their meeting the following day.

Unfortunately for speculators, Jerome Powell sounded extremely hawkish and determined to continue with tight monetary policy until inflation was down near their 2% goal. Here is a brief summary of Powell’s statements via Zerohedge:

Then The Fed and Powell’s presser smashed the vase of fantasy on the ground of reality with a hawkish statement and projections and an even more hawkish Powell.

∙ POWELL: LABOR MARKET REMAINS EXTREMELY TIGHT

∙ POWELL: A RESTRICTIVE POLICY STANCE LIKELY NEEDED FOR SOME TIME ∙ POWELL: NEED SUBSTANTIALLY MORE EVIDENCE OF LOWER INFLATION ∙ POWELL: FED STILL HAS SOME WAYS TO GO ON RATE HIKES ∙ POWELL: STANCE ISN’T YET RESTRICTIVE ENOUGH EVEN W/ TODAY’S MOVE ∙ POWELL: NO RATE CUTS UNTIL CONFIDENT INFLATION MOVING TOWARD 2% ∙ POWELL: WILL HAVE TO HOLD RESTRICTIVE RATES FOR SUSTAINED TIME

The FOMC provided an updated projection for the median Fed Funds Rate. The terminal rate now is expected to be 0.50% higher than previously projected and could hit 5.1% in 2023. The rate in 2025 is expected to be around 3.1%. See the new projections in the graph below.

It is important to note that the Fed has raised the terminal rate at every meeting this year. In January 2022, investors were expecting a 1% FFR by the end of the year. Current Fed projections are for a 4.4% Fed Funds rate at year end. And many investors seem to have completely forgotten the Fed is reducing their balance sheet (Quantitative Tightening) to the tune of around $95 billion per month.

Absent some unexpected news, it appears the Fed is determined to maintain its tightening stance until inflation falls much further. The current terminal rate is expected to be 5.1% next year but remember that estimate has been raised at each meeting. The Fed’s current position will not help fuel a Santa Claus rally. However, in today’s markets, one never knows what will pop up from day to day.

The S&P 500 Index closed at 3,852, down 2.1% for the week. The yield on the 10-year Treasury Note fell to 3.48%. Oil prices rose to $74 per barrel, and the national average price of gasoline according to AAA decreased to $3.15 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.