Executive Summary

During the first two quarters of 2022, GDP growth was negative. The unofficial definition of a recession. Third quarter GDP estimates vary; however, look to be positive. Does this change an expected recession outlook? The NBER officially declares recessions, and it is usually six months to a year after the start. In The Details there are two quotes of what they look for to define recession. Leading indicators of recession, in data back to 1959, at current levels have always led to recession. So, while the third quarter may be positive, indicators and expectations of recession continue.

Please continue to The Details for more of my analysis.

“Ask five economists and you’ll get five different answers – six if one went to Harvard.”

–Edgar R. Fiedler

The Details

Gross Domestic Product (GDP) fell 1.6% in the first quarter on a seasonally adjusted annual rate basis (SAAR). In the second quarter, growth dropped 0.6%. Technically, this indicates the U.S. is in a recession. However, the National Bureau of Economic Research (NBER), the arbiter of recession dating, will not officially declare the start date of a recession until after the fact. Once they have reviewed the economic data, including subsequent data releases, they will make their determination. Historically, this could take 6 – 12 months after the actual start date.

On October 27th, the Bureau of Economic Analysis (BEA) will announce the advance reading for third quarter GDP growth. Estimates for third quarter growth have fluctuated wildly over the quarter. Even now, the estimates are quite disparate. The Atlanta Fed’s GDPNow model is predicting a rebound in growth of 2.8%. The consensus of economists is around 1.4% positive growth. Hedgeye Risk Management is currently forecasting 0.81%. Most projections for the third quarter are showing positive growth, with a return to negative growth in 2023.

The main factor in third quarter growth appears to be net exports. Exports of goods add to GDP, while imports are subtracted. During the third quarter, even with exports falling, the trade deficit narrowed. It just happens that imports fell more. This was due to weakening demand for goods and falling real income.

Would positive growth mean a potential recession is over? The simple answer is no. According to the NBER’s website:

“The NBER’s definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. In our interpretation of this definition, we treat the three criteria—depth, diffusion, and duration—as somewhat interchangeable.”

The NBER is looking for peaks and troughs in economic cycles. They further state on their website:

“Because a recession must influence the economy broadly and not be confined to one sector, the committee emphasizes economy-wide measures of economic activity. The determination of the months of peaks and troughs is based on a range of monthly measures of aggregate real economic activity published by the federal statistical agencies. These include real personal income less transfers, nonfarm payroll employment, employment as measured by the household survey, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, and industrial production.”

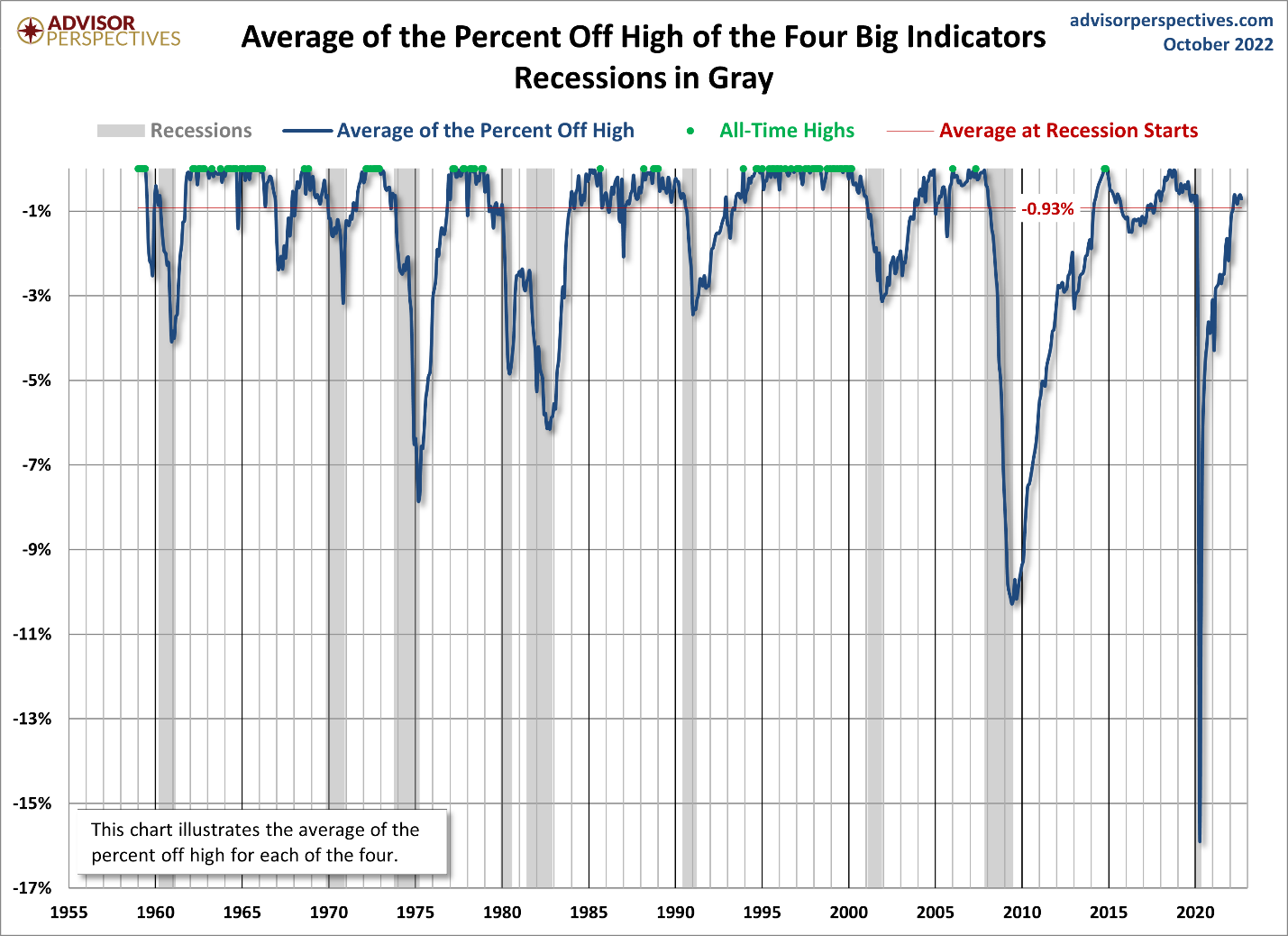

Advisor Perspectives has prepared a graph showing the percentage off of the recent high for the average of the four main economic categories. The graph below indicates that current levels, using data back to 1959, are close to or below the start of previous recessions.

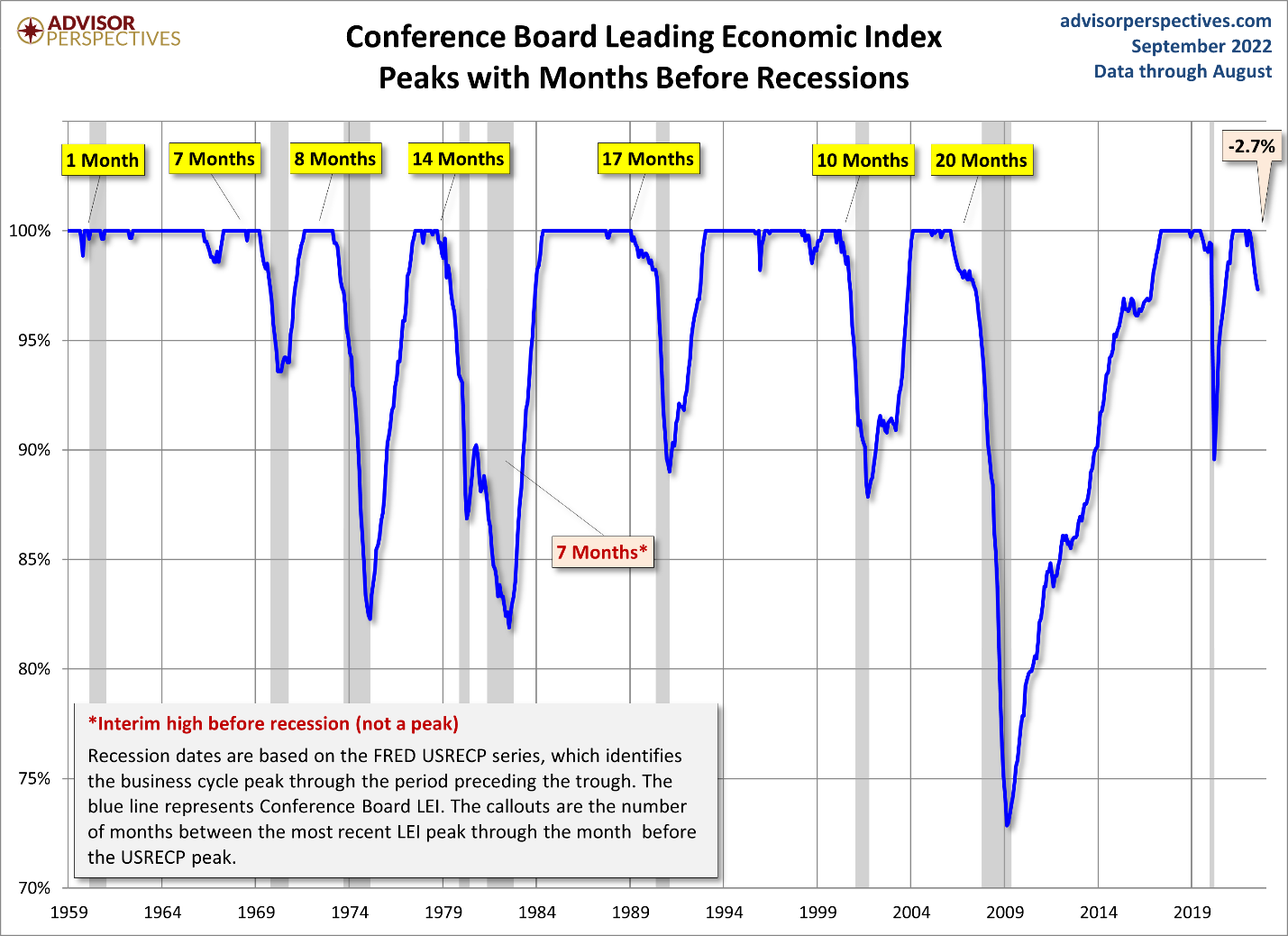

The Conference Board prepares an Index of Leading Economic Indicators (LEI). The current level of the LEI, again going back to 1959, has always led to a recession.

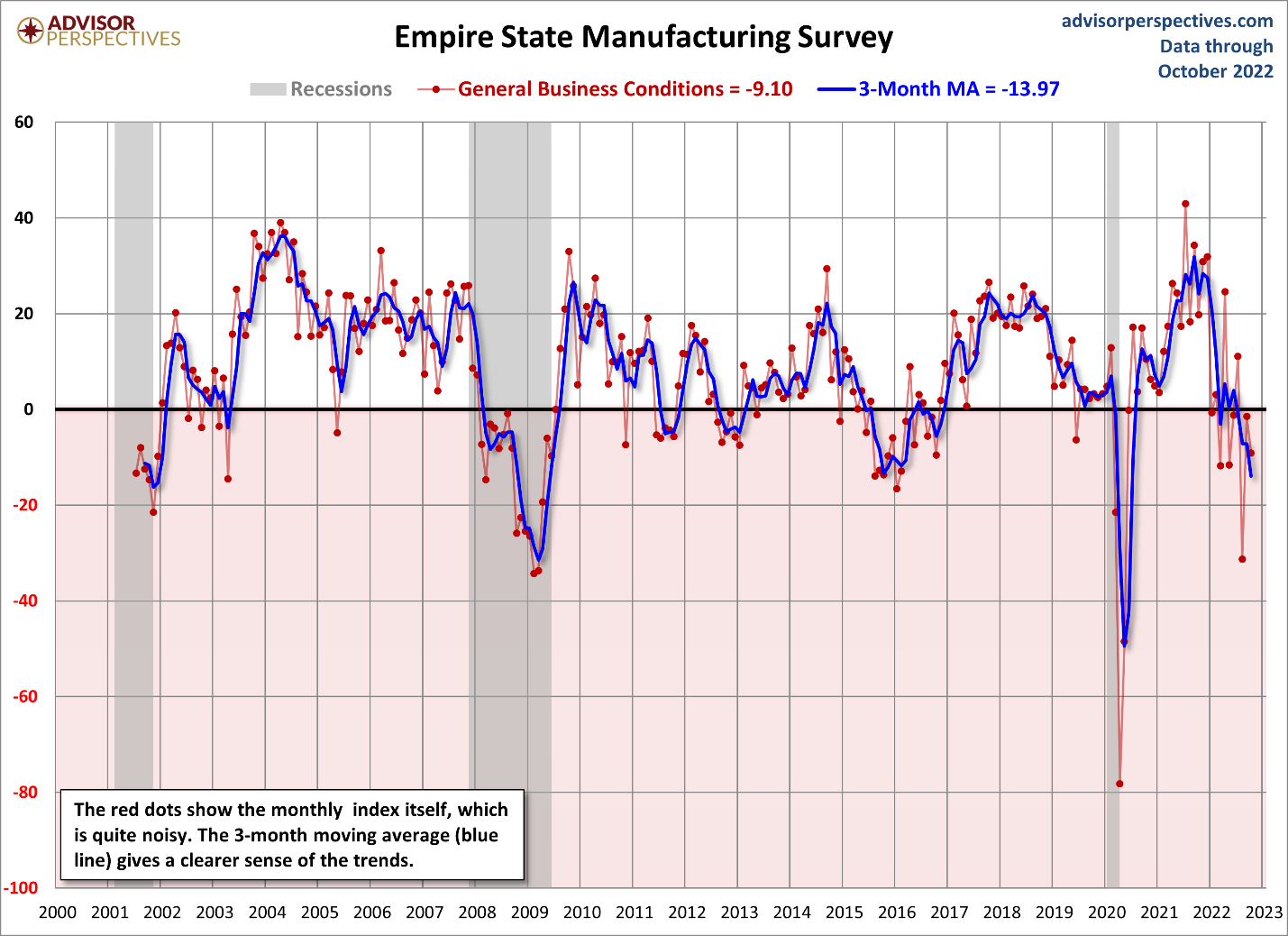

Monday, October 17th, the New York Fed Empire State Manufacturing Survey was released showing the General Business Conditions diffusion index fell 9.1% from a previous reading of minus 1.5%. Expectations were for a drop of 4%. This index (shown below) is derived from a survey of around 200 manufacturers in New York State. A negative number indicates worsening conditions.

On October 27th the advance reading of third quarter GDP growth will be released. Even if a significant drop in imports boosts growth, that does not cancel the possibility that the U.S. is in a recession. Economic data being released indicates a weakening economy domestically and even more so on a global basis. There is currently nothing to indicate this trend will reverse anytime soon. Expectations of recession continue.

The S&P 500 Index closed at 3,583, down 1.6% for the week. The yield on the 10-year Treasury Note rose to 4.01%. Oil prices fell to $86 per barrel, and the national average price of gasoline according to AAA decreased to $3.89 per gallon.

—-

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.