Executive Summary

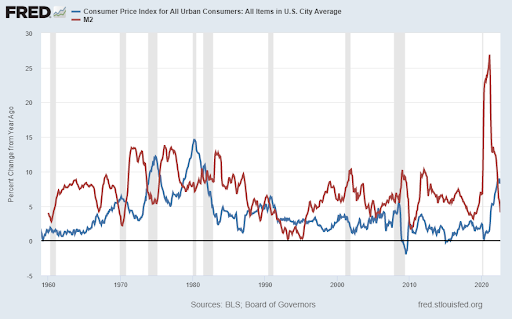

In this issue, I draw upon an article published on Mises Institute, by Thorsten Polleit titled: Inflation, High Inflation, Hyperinflation. As written in the article, “Goods price inflation is the symptom, and money supply inflation is its cause.” Each time the money supply has risen significantly, the rate of inflation or increase in CPI follows (see first graph below). The money supply has been increasing for years; however, the increase turned almost vertical at the time of the pandemic. Currently energy prices and other supply constraints are contributing to inflation. But the substantial increase in the money supply via monetizing government stimulus programs created excess demand, and thus price inflation. Please see the last quote below explaining how society moves from high inflation to hyperinflation.

Please continue to The Details for more of my analysis.

“Hyperinflation can take virtually your entire life’s savings, without the government having to bother raising the official tax rate at all.”

–Thomas Sowell

The Details

In my September 13th newsletter, I discussed the impact of inflation. The following week, I reviewed the Federal budget deficit and National debt. In summary, I explained how, absent serious budget reductions, there are only two possibilities for reducing the debt balance to a reasonable percentage of the economy: default or hyperinflation. I described how since the U.S. dollar serves as the global reserve currency, and the Federal Reserve Bank (Fed) has the ability to print as much money as they see fit, default is an unlikely result. Some readers might have felt that hyperinflation is a bit farfetched. I will attempt to outline in this week’s missive how it might not be as farfetched as some believe. In this newsletter, I will be drawing upon information provided in an article entitled, Inflation, High Inflation, Hyperinflation by Thorsten Polleit published on Mises Institute on September 23, 2022. All items in quotation marks represent quotes from this article.

There are two explanations for the current bout of inflation. First, soaring energy prices due to government restrictions combined with supply restraints. The excess demand for goods and services is a direct result of the second explanation, an increase in the money supply. As economist Milton Friedman has said, “Inflation is always and everywhere a monetary phenomenon.” The resulting increase in prices can be in consumer goods and/or asset prices. The graph below prepared with data from the St. Louis Fed FRED database compares prices (using the Consumer Price Index) to the money supply (using M2). Notice below that prior to each major increase in prices (CPI – blue line) the money supply had risen significantly (M2 – red line).

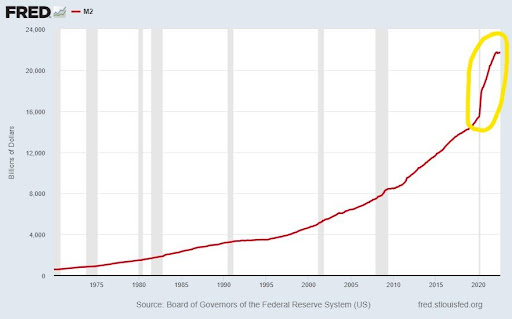

The above graph is expressed in year-over-year rate of change terms. The graph below illustrates the tremendous increase in the money supply from about $590 billion in 1970 to around $22 trillion today. Notice the drastic increase in the slope of the line after the start of the pandemic (circled in yellow). As written in the article, “Goods price inflation is the symptom, and money supply inflation is its cause.”

By setting a permanent goal of an average of 2% inflation, central banks are not protecting the currency, but instead are destroying it. To achieve hyperinflation, the article states that a permanent price increase of about 3% per month would satisfy the definition.

If you are wondering what would cause this to happen, you only have to review my newsletter of September 20th describing the U.S. fiscal debt crisis. When a society becomes so overindebted that the only way to continue financing the debt is to monetize it through central bank purchases (i.e., Quantitative Easing), it is well on its way to hyperinflation. “The economist Ludwig von Mises put it succinctly when he wrote in 1923:

‘We have seen that if a government is not in a position to negotiate loans and does not dare levy additional taxation for fear that the financial and general economic effects will be revealed too clearly too soon, so that it will lose support for its program, it always considers it necessary to undertake inflationary measures. Thus inflation becomes one of the most important psychological aids to an economic policy which tries to camouflage its effects. In this sense, it may be described as a tool of antidemocratic policy. By deceiving public opinion, it permits a system of government to continue which would have no hope of receiving the approval of the people if conditions were frankly explained to them.’”

Eventually, the prices of goods increase at a pace higher than that of wages and income. The government soon has to increase its debt to finance additional social spending. As the spiral continues, people lose faith in the currency and seek alternative goods to purchase versus holding cash. This accelerates the increase in prices. And the spiral continues.

Presently, the U.S. is in high inflation. The mere fact that former Fed Chairman, Ben Bernanke, (founder of modern day QE) just received the Nobel prize in economics, proves that central banks only see one solution. As written in the subject article, “… central banks’ policies in recent years have made it unmistakably clear that printing money is seen as the least evil in times of distress. And this is unmistakably the attitude of inflationism, which promotes inflationary policies. […]

Looking at it this way, one can say that high inflation is here to stay. Hyperinflation may not be at our doorstep just yet, but it is getting closer to our house every day – if the currently prevailing mentality on economic and sociopolitical matters does not change very soon, hyperinflation will come knocking – and eventually kick in the door.

While it is impossible to say when that might happen, in my opinion, the occurrence of hyperinflation in the fiat money system is very likely; in fact I fear it is almost inevitable.”

If it is not evident based upon my prior missives, I tend to agree with the author of this article.

The S&P 500 Index closed at 3,640, up 1.5% for the week. The yield on the 10-year Treasury Note rose to 3.89%. Oil prices rose to $93 per barrel, and the national average price of gasoline according to AAA increased to $3.91 per gallon.

I always like to take a moment of my day to be grateful for the life I life and to think of new ways to help those around me.

With that being said, I’d like to invite you to join me in supporting St. Jude’s Children’s Research Hospital.

I am a St. Jude Hero! I have chosen to run for a reason bigger than myself by fundraising for the kids and families at St. Jude. I am training to cross the finish line on race day and with your donation, we can cross the fundraising finish line together because the money you donate helps find a cure for childhood cancer.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.