Executive Summary

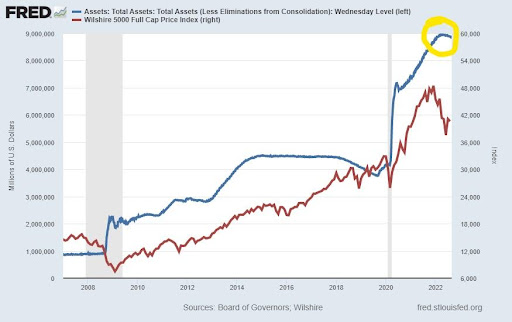

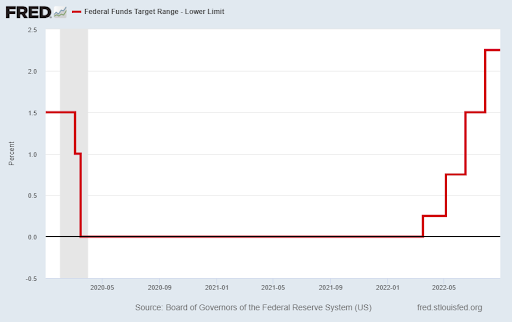

Between the 2008 Financial Crisis and the start of the pandemic, the Federal Reserve Bank increased its balance sheet from approximately $850 billion to about $4 trillion. From there the pandemic created a panic, and they further increased it to nearly $9 trillion (See first graph, notice near vertical move of blue line). This unprecedented policy contributed to the massive rise in inflation. To fight inflation, the Fed is raising interest rates and reducing the bloated $9 trillion balance sheet. The Federal Funds Rate has been raised to 2.25% (lower limit), and the balance sheet rate of reduction is about to double to $95 billion per month starting in September. Speculators are waiting for a Fed policy “pivot.” However, as heard in the Jerome Powell quote included below, that is not happening. It appears they are just getting started.

Please proceed to The Details.

“The government solution to a problem is usually as bad as the problem.”

–Milton Friedman

The Details

During the Financial Crisis in 2008, the Federal Reserve Bank (Fed) began a series of Quantitative Easing (QE) programs where they purchased Treasury bonds and Agency mortgage-backed securities. Between 2008 and the start of the pandemic in 2020, the Fed had grown their balance sheet from approximately $850 billion to around $4 trillion. The halting of the economy during the pandemic created panic at the Fed and in the Federal Government. To quell the economic onslaught, they decided to use QE on steroids to keep the economy running. Notice the blue line in the graph below skyrocketing by almost $5 trillion between 2020 and 2022, pushing total assets to about $9 trillion. These massive injections of liquidity helped the psyche of investors as they flooded the equity market pushing the Wilshire 5000 total equity market index, shown in red below, to the most overvalued position in history.

At the start of 2022, the Fed became frightened by how much inflation had risen, and to their dismay, was not “transitory” as they had earlier proclaimed. Fearing losing control of inflation, they determined to do an about face with monetary policy and announced plans to reduce the size of their balance sheet. This reduction would be labeled QT or Quantitative Tightening and would begin in June 2022 at a level of about $47.5 billion per month. The plan was to allow maturing bonds to roll off the balance sheet instead of reinvesting the proceeds. To date, the amount of “roll off” appears to be miniscule compared to the size of the balance sheet (see yellow circle in the graph above).

In addition to QT, the Fed began increasing the short-term Federal Funds Rate (FFR), which had been dropped to about zero percent during the pandemic. Historically, when the Fed raised the FFR, they typically did so in 0.25% (25 basis point) increments. Therefore, in March the Fed raised the rate to 0.25% (FFR lower limit). However, as time crept by, the Fed realized inflation was quickly getting out of control and they would need to do more to try and halt the price increases. So, in May the Fed raised the FFR by 50 basis points to 0.75%. Then in June and July they hiked the rate by 75 basis points in each month bringing the FFR to 2.25%. See the chart below.

The entire time the Fed has been tightening, speculators have been parsing every word out of Fed Chairman Jerome Powell’s mouth hoping to catch a whiff of a potential change in policy which could lead to a return to a bull market. The recent strong bear market rally was based upon speculators’ hopes for the Fed to “pivot” and halt the monetary tightening. Although never actually providing any validation for their hopes, Chairman Powell decided to put the kibosh on these rumors, when he spoke at the Jackson Hole meeting last Friday. His speech was much more hawkish than most investors were hoping to hear. Below is an excerpt from that speech (emphasis mine):

“Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

This speech sent a reality check through market participants last Friday as the Dow fell over 1,000 points, and most indices were down over 3%. The bear market rally has officially ended. One facet of monetary tightening that has been overlooked so far is QT. However, beginning in September, the amount of monthly QT will double to $95 billion per month. This huge amount of balance sheet reduction combined with no immediate plans for halting interest rate hikes could send a jolt through the still massively overvalued stock market. The policy is intended to reduce demand for goods and services, attempting to bring inflation down. This demand reduction will likely make the economic downturn worse, pushing the U.S. into a deeper recession. While the Fed can reduce demand through these policies, they cannot impact the portion of inflation arising from supply constraints. As such, a period of deep recession and inflation – stagflation – could be in store.

The downturn in the stock market could get much more severe when the additional QT begins next month at the same time the economy continues to weaken. Fed tightening is just getting started.

The S&P 500 Index closed at 4,058, down 4% for the week. The yield on the 10-year Treasury

Note rose to 3.04%. Oil prices increased to $93 per barrel, and the national average price of gasoline according to AAA fell to $3.85 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.