Executive Summary

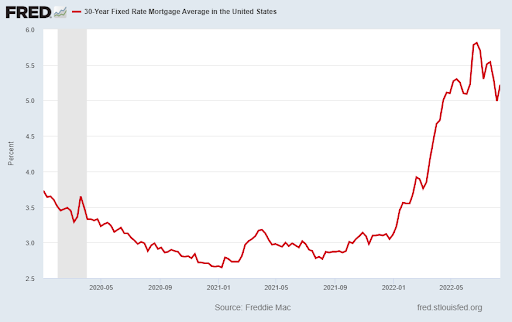

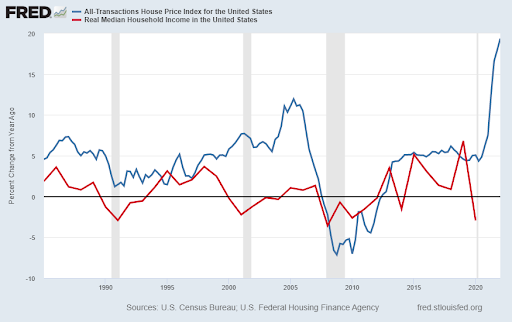

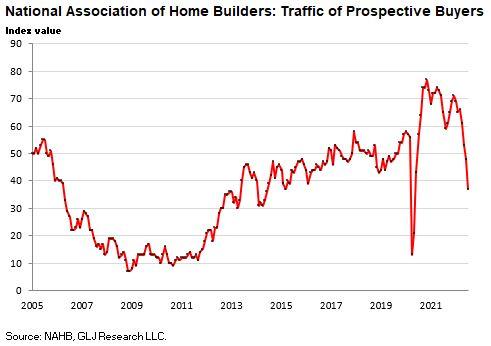

Mortgage rates have nearly doubled from 2.65% to 5.22%, resulting in a slowing housing market. Add in a drop in real median household income, and now there is a record gap between housing prices and incomes (see 2nd graph). Meanwhile the supply of homes is increasing while the existing home sales are decreasing. The National Association of Home Builders (5th graph) published a near vertical drop in “traffic of prospective buyers.” Historically the housing sector has weakened prior to most recessions, and clearly the data is weakening. Please see the drastic change occurring in housing illustrated in the graphs below.

Please proceed to The Details.

“People want what they want. And I guess that is a reason we have this big credit card problem and a lot of these foreclosures.”

–Chris Rock

The Details

The housing sector appears to be underscoring the signal that a recession is here or near. Housing has weakened prior to most recessions. The 97% surge in mortgage rates from a low of 2.65% in January 2021 to the current 5.22% has put the brakes on an overheated housing market.

Housing prices soared after the pandemic stimulus boost to the economy. However, as shown in the graph below, the drop in real median household income has created a record gap between housing prices and income. Add in the jump in mortgage rates and you have a perfect recipe for housing unaffordability.

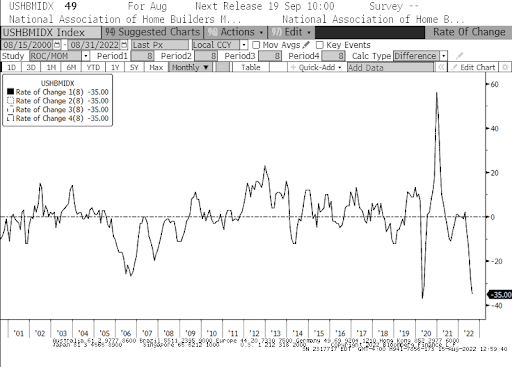

Activity in the housing market confirms a significant slowdown is in progress. The National Association of Home Builders/Wells Fargo Housing Market Index has fallen the fastest in its history outside of the drop due to the pandemic. The Index fell to 49, below 50 represents contraction. As written in an article on CNBC.com, “Tighter monetary policy from the Federal Reserve and persistently elevated construction costs have brought on a housing recession,” said NAHB Chief Economist Robert Dietz.”

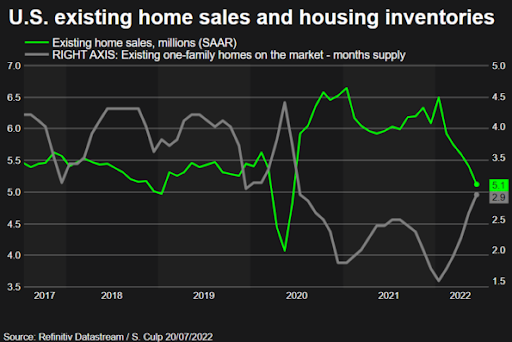

According to Realtor.com, “The national inventory of active listings increased by 30.7% over last year, a record high growth rate.” The added inventory is increasing the months’ supply of homes, while existing home sales plunge.

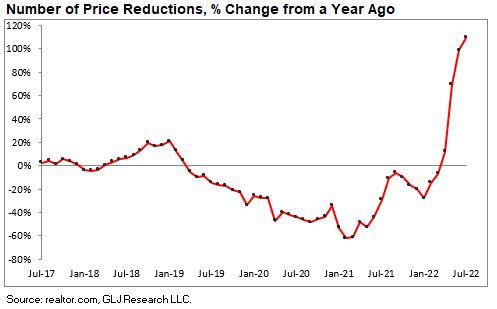

The National Association of Home Builders data indicates prospective buyer traffic is plummeting, as seen in the graph below. And the second graph illustrates the huge increase in “price reductions” on listed homes. (h/t to Gordon Johnson for graphs.)

All-in-all, the data shows the housing market has come to an abrupt about face. As the economy weakens and eventually an “official” recession is declared, more home buyers will become reluctant to purchase. Existing homeowners, who locked-in low mortgage rates will be hesistant to “move-up” to a larger home, since they will likely have more difficulty selling their existing home. Aslo, a mortgage of the same amount would cost about 35-40% more per month due to higher interest costs alone. Add on a larger purchase price and likely higher property taxes and “moving-up” could be quite costly. Then there is the concern about potential job-losses in a recession.

After over 10 years of a Fed-fueled housing bubble, briefly interrupted and then juiced further by the pandemic, the housing market appears to be rapidly approaching recession. Since the Fed is determined to continue raising interest rates in the face of high inflation, at the same time global and domestic economies are dramatically slowing, the housing recession is likely foreshadowing a larger economic recession.

The S&P 500 Index closed at 4,280, up 3.3% for the week. The yield on the 10-year Treasury

Note rose to 2.85%. Oil prices increased to $92 per barrel, and the national average price of gasoline according to AAA fell to $3.96 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.