Executive Summary

Inflation, or general price increases, are reported through the Consumer Price Index which is currently up 8.6% – a 40-year high (second graph). The Federal Reserve Bank contributed to inflation with loose monetary policy along with U.S. government stimulus programs. In order to fight high inflation, the Fed is now attempting to slow demand without causing a recession. Which may be too late with first quarter 2022 showing negative growth and second quarter predictions being close to negative. Food and energy, as well as other commodity prices, are not really controlled by Fed actions. Supply constraints caused by government policies, the war and other factors have pushed commodity prices higher. Lower demand from high food and energy cost may not be enough to offset prices increases due to supply constraints, which could mean inflation may remain the case. Inflation is far too complicated and deep for a short newsletter; however, proceed to The Details for a more complete understanding.

Please proceed to The Details.

“A nickel ain’t worth a dime anymore.”

–Yogi Berra

The Details

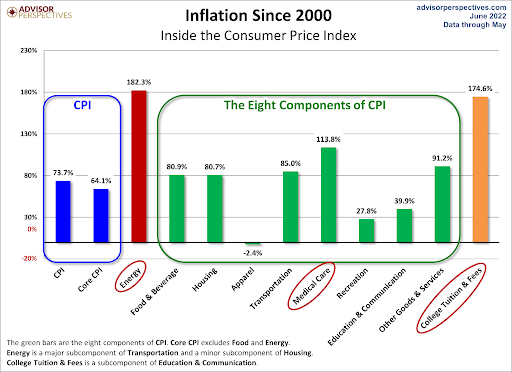

Presently, there is a huge debate among economists as to what is coming down the pike: continued inflation or a pivot to deflation. This subject is far too deep to thoroughly cover in a short newsletter, but I will attempt to highlight some important aspects. “Inflation,” or general increases in prices, is often reported through the use of the Consumer Price Index (CPI). The Bureau of Labor Statistics (BLS) segregates items into eight categories when calculating the CPI. The chart below delineates the eight components, highlighting inflation since 2000. Two items with the highest inflation, energy and college tuition, are actually subcomponents of the eight main categories.

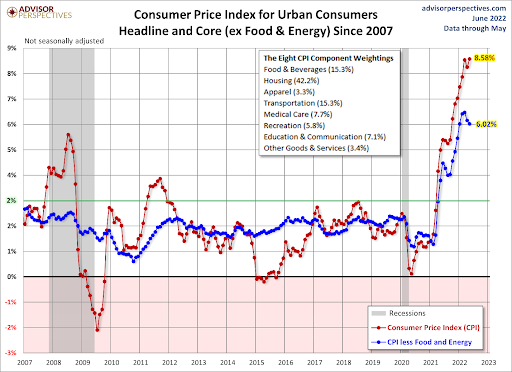

Because of the volatility of food and energy costs, the BLS also reports the “Core” CPI excluding these items. Notice in the graph below that the Core CPI was about 6% year-over-year in May versus the Headline CPI’s 8.6% increase. This might seem ludicrous since most people, especially middle and lower income families, tend to spend a significant amount of money on food and energy.

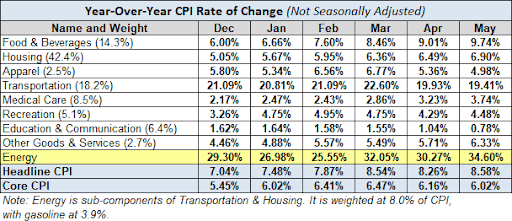

A combination of extremely loose monetary policy and supply constraints has pushed the Headline CPI to 40-year highs. Notice in the chart below the three categories with the highest price increases are energy, transportation (which includes certain energy components) and food.

In order to reduce the level of inflation, the Fed is raising the short-term Federal Funds interest rate and reducing the size of their balance sheet (Quantitative Tightening or QT). They believe by tightening monetary policy, consumers will reduce their demand for goods and services, thus slowing the economy sending prices lower. The Fed is attempting to walk a tightrope by slowing demand without pushing the economy into recession. Unfortunately, it appears it is too late for that, as the economy is likely in or about to enter a recession.

With no more Federal stimulus payments, consumers have already turned to credit cards to make ends meet. Soaring gasoline and food prices are making it difficult for many families. At the same time demand is falling, many stores are swimming in inventory. According to an article on CNN.com:

“In recent weeks, some of the biggest store chains, including Target (TGT), Walmart (WMT), Gap (GPS), American Eagle Outfitters (AEO) and others have reported in their latest earnings calls that they have too much inventory of stuff ranging from workout clothes, spring-time jackets and hoodies to garden furniture and bulky kids’ toys. It’s costing them tons of money to store it.

Now add on to that glut another category of product that stores have to deal with: returns.

So instead of piling returned merchandise onto this growing inventory heap, stores are considering just handing customers their money back and letting them hang onto the stuff they don’t want.”

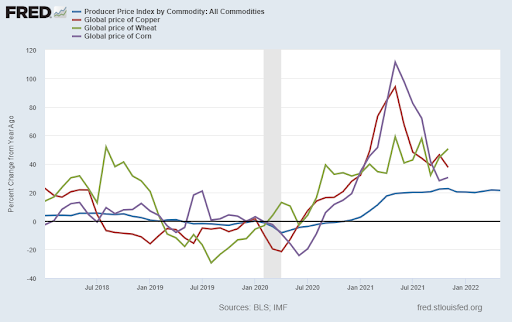

The Fed, however, has little control over the prices of many commodities. It is the prices of these commodities, including food items and energy costs, which are hurting most consumers the most. Notice in the graph below, the overall commodity index (blue line) is increasing at a steady, albeit high, pace. Many of the other commodities are still increasing at a high pace, just a slower rate of change than last year.

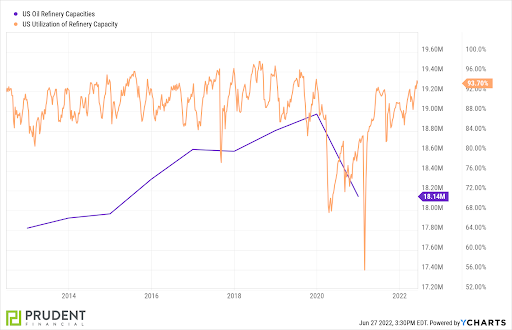

The Fed can attempt to engineer an overall economic slowdown, but that will not by itself reduce commodity costs. Supply constraints due to government policies, the war in Ukraine and other factors, have pushed prices higher. One of the most significant contributors to inflation is the price of gasoline. Notice in the graph below, oil refinery capacity has fallen since 2020 and is currently about 17.9 million barrels per day (blue line). And capacity utilization is at 93.7%, below 2020 utilization levels.

The battle raging on is whether reduced demand will trump supply and capacity constraints. In my mind it appears clear a recession is here or near; therefore, demand for many items will fall. This will put downward pricing pressure on many items. However, people will continue to demand food, gasoline and other energy products, just at a slower pace. The lower demand for these items might not be enough to offset the constraints.

Other inflationary pressures could come from companies, many of whom have never shown a profit, who are getting squeezed with massive increases in input costs. These include pressures to increase wages by employees suffering from rising prices. These pressures could force companies to continue raising prices even in the face of slowing demand. Has anyone taken an Uber or Lyft lately? Notice an increase in prices?

As stated before, inflation is far too complex to give justice in a brief newsletter. However, the battle rages on as to what comes next. With the pace of changes in the economy, my opinion could change with the facts. Currently, I believe most citizens will continue to face significant inflationary pressure as the economy moves into stagflation. Consumers will continue to feel the impact of high food and energy costs as the economy falls into recession. There are many moving parts incorporated into the inflation argument. Unfortunately, until energy and commodity prices fall on a more permanent basis, inflation remains the likely case.

The S&P 500 Index closed at 3,912, up 6.4% for the week. The yield on the 10-year Treasury

Note fell to 3.12%. Oil prices dropped to $108 per barrel, and the national average price of gasoline according to AAA decreased to $4.90 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.