Executive Summary

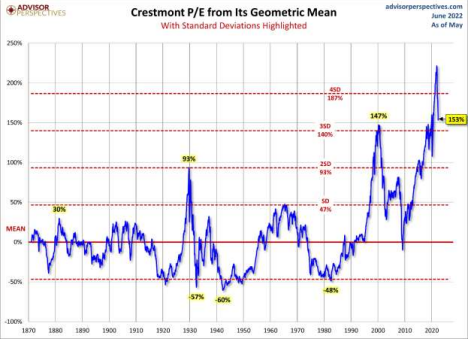

Over the last ten years or more of loose Fed monetary policy, investors began to believe stocks would only go up in price. Extremely low-interest rates could not compete with the two percent S&P 500 dividend yield. Investors took on more risk than what was suitable and loaded up portfolios with heavy stock allocations. Now Fed policy is changing, inflation and interest rates are rising, and economic activity is falling. Even with the drop in stock prices this year, stock valuations are still overvalued (see last graph) and risk is high. However, there are now alternatives.

Please proceed to The Details.

“The best investors do not target return; they focus first on risk, and only then decide whether the projected return justifies taking each particular risk.”

–Seth Klarman

The Details

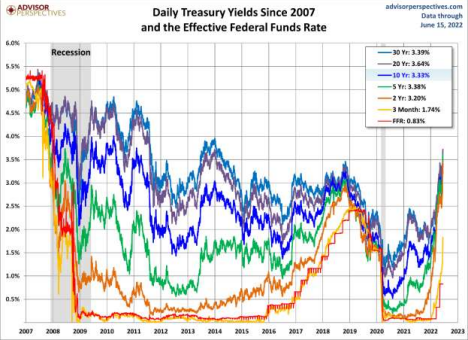

Over the past decade, many investors were convinced by TINA to take on far more risk than was suitable for their situation. Short-term interest rates were lowered to near zero percent and longer-term rates were falling. The Federal Reserve Bank (Fed) was engaging in massive Quantitative Easing (QE) programs. One of the byproducts of loose monetary policy was to bestow upon investors the belief the stock market would continue to rise indefinitely. As interest rates continued lower (see below) investors were persuaded to say: There Is No Alternative (TINA) to stocks.

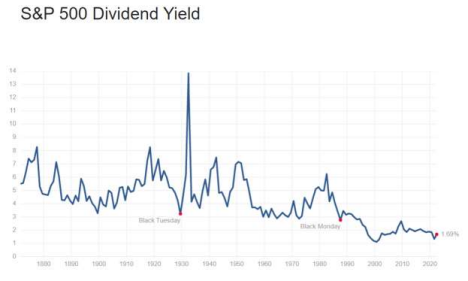

Dividend yields were hovering around 2%, exceeding short-term interest rates. Investors believed the Fed would continue to prop-up the stock market and dividend yields were higher than short-term rates, so all justifications to only invest in stocks.

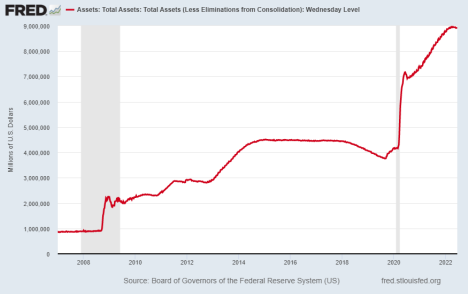

Throwing caution to the wind, watching the Fed balance sheet grow along with the stock market, many investors increased their allocation to equities. Some used margin (debt) to increase their equity positions.

Talk of valuations and fundamentals faded into the wind as they seemed no longer relevant. The only thing that mattered was monetary policy. As the stock market grew, valuations increased to the highest levels ever recorded. Investors ignored the risk embedded in their portfolios because remember TINA. However, now with inflation raging and the Fed raising rates, the yield on 2- year Treasury Notes is over 3%, thus exceeding dividend yields. Additionally, the stock market is falling as inflation and higher interest rates are putting the brakes on consumption. The economy is rapidly declining. Corporate profit margins are getting squeezed as corporations are not able to pass through the full impact of their rising input costs. Suddenly, valuations seem to matter again.

And even with the roughly 23% drop in the S&P 500 this year, the market remains more overvalued than in any previous cycle.

The belief in TINA was dangerous because it ignored the fact that stock prices were at record bubble levels. The risk of a sudden and significant downturn in stock prices has been growing for a decade. Now, as earnings decrease, the economy nears a recession, inflation remains high, interest rates are rising and the Fed is reducing its balance sheet, investors are becoming more fearful and are selling stocks. The risk of sudden and dramatic drops in stock prices remains. Short-term interest rates are now providing investors with an alternative. It seems TINA is gone.

The S&P 500 Index closed at 3,675, down 5.8% for the week. The yield on the 10-year Treasury Note rose to 3.28%. Oil prices fell to $109 per barrel, and the national average price of gasoline according to AAA decreased to $4.98 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.