Executive Summary

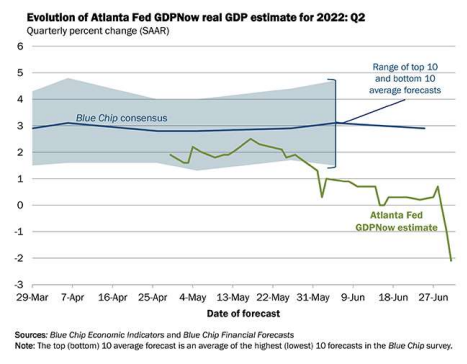

During the first quarter, economic growth fell 1.6%. Many expected a rebound in Q2. Unfortunately, according to the Atlanta Fed’s GDPNOW forecasting model, the economy shrank again in the second quarter by an estimated 2.1%. Two consecutive quarters of negative growth is what many pundits use to define a technical recession. The National Bureau of Economic Research (NBER) is the official arbiter for dating recessions. Their declaration tends to lag up to six months or more after the official start date. The definition assigned by the NBER is “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” Without revealing their formula, it is believed that a downturn in four main categories dominates their decision-making. The four indicators include: employment, industrial production, real retail sales, and real personal income. Please see The Details below for an analysis and graphs of these four categories.

Please proceed to The Details.

“People stop buying things, and that is how you turn a slowdown into a recession.”

–Janet Yellen

The Details

Last Thursday marked the end of the second quarter. During the first quarter, economic growth fell at an annual rate of 1.6%. Many expected a rebound in Q2. Unfortunately, according to the Atlanta Fed’s GDPNOW forecasting model, the economy shrank again in the second quarter by an estimated 2.1%. Two consecutive quarters of negative growth is the test many pundits use to define a technical recession.

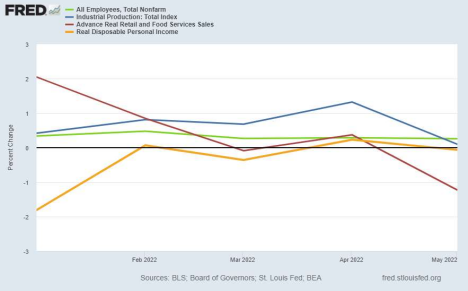

The National Bureau of Economic Research (NBER) is the official arbiter for dating recessions. Their declaration tends to lag up to six months or more after the official start date. The definition assigned by the NBER is “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” The NBER does not elaborate on the ingredients for their secret sauce for declaring an official recession. It is believed that a downturn in four main categories dominate their decision-making. The four indicators include employment, industrial production, real retail sales and real personal income.

Notice in the graph below, two of the indicators – real retail sales and real disposable personal income – are in contraction. Industrial production’s rate of change is decreasing and appears it will soon fall into contraction. And employment growth is declining. Recently, several large companies announced planned layoffs. This is before the release of reduced Q2 earnings due to falling revenue and compressed margins resulting from inflation.

In an article in Business Insider entitled, “A wave of layoffs is sweeping the U.S. Here are firms that have announced cuts so far, from Compass to Coinbase” here are some of the corporate announcements:

∙ Compass: 450 employees. …

∙ Redfin: About 6% of total employees. …

∙ Coinbase: About 18% of its workforce. …

∙ Tesla: Hiring freeze, and potential layoffs reportedly coming to 10% of staff. … ∙ Carvana: About 2,500 people. …

∙ Reef: About 750 people. …

∙ Gopuff: More than 400 people.

There will likely be many more corporate layoffs announced as the economy continues to weaken. As reported by Trading Economics, “The ISM Manufacturing PMI fell to 53 in June of 2022 from 56.1 in May, pointing to the slowest growth in factory activity since June of 2020, and below market forecasts of 54.9. New orders contracted for the first time in two years (49.2 vs 55.1), in a sign rising interest rates are hurting demand. Also, employment declined further (47.3 vs 49.6) …” Below 50 indicates contraction.

According to Advisor Perspectives, “Real Retail Sales, calculated with the seasonally adjusted Consumer Price Index, decreased by 1.23% and was down 0.39% YoY.”

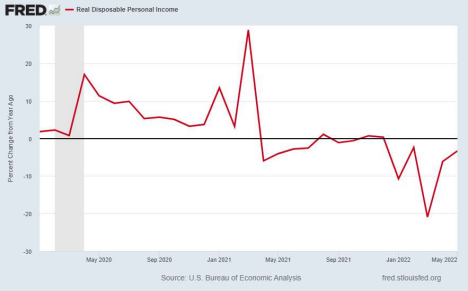

Notice in the graph below that Real Personal Disposable Income has been declining on a year over-year basis since around April 2021 (except for a few flat months).

An unprecedented amount of stimulus was injected into businesses and provided to individuals during 2020 and early 2021. These stimulus payments boosted overall economic growth, consumption and savings. Since then, the funds have quickly run dry, and the economy is already turning downward. Consumers are saving less, using credit cards to make ends meet, while businesses are scaling back. A perfect storm emerged as stimulus disappeared, debt rose, and inflation soared. Now, after having blown through almost $5 trillion in government handouts, and at the end-phase of a stock market bubble, the Fed is charged with reducing inflation. Unfortunately, the horse has left the barn.

The Fed’s prescription of higher short-term interest rates and Quantitative Tightening (QT) combined with high inflation and supply constraints, have quickly put a halt to economic growth. At the same time the stock market is in a bear market, and a fight between inflation and deflation is about to ensue. Everyone is looking to the Fed to revert back to loose monetary policy. As I have stated before, the Fed is boxed into a corner. With no easy solution and an election around

the corner, I expect the Fed to continue tightening for the time being. As such, I expect the economy to worsen, and the recession to deepen.

The S&P 500 Index closed at 3,912, down 2.2% for the week. The yield on the 10-year Treasury Note fell to 2.89%. Oil prices remained at $108 per barrel, and the national average price of gasoline according to AAA decreased to $4.81 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.