Executive Summary

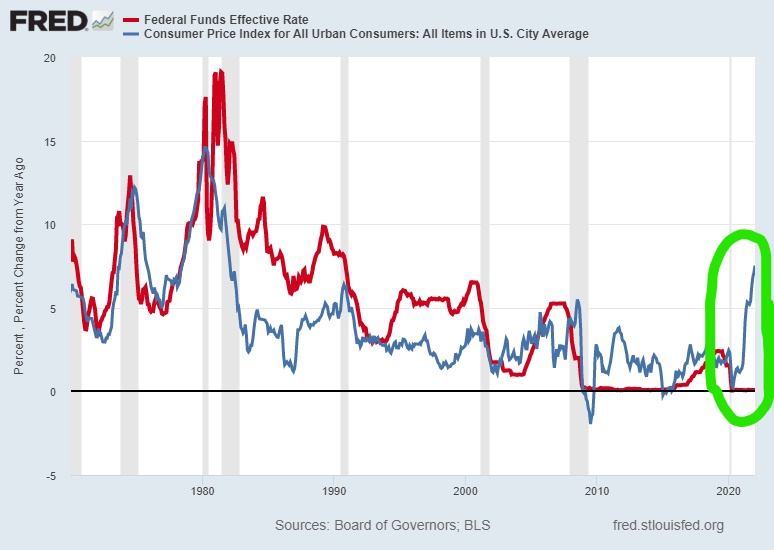

The Federal Reserve Bank (Fed) has two mandates: maximum employment and stable prices. However, their addition of a third unwritten mandate – propping up financial markets – has paralyzed them from addressing the current exorbitant price instability – or inflation. From 1970 to present, the Fed has never previously allowed inflation to rise so high without a corresponding increase in the Fed Funds rate (see second graph below). The staggering inflation is having a negative impact to the average U.S. household. A recent article in The Wall Street Journal estimated households are spending around $276 more a month due to inflation. Economist Stephen Roach of Project Syndicate recently wrote in his article “The Fed Is Playing With Fire,” “By now, it is passé to warn that the Fed is ‘behind the curve.’ In fact, the Fed is so far behind that it can’t even see the curve.”

Please proceed to The Details.

“There are only two times. Now and too late.”

–Anh Do

The Details

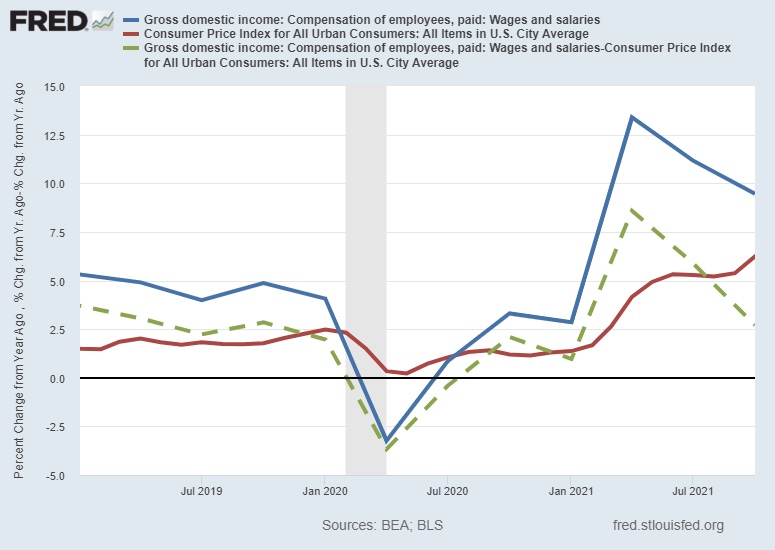

The Federal Reserve Bank (Fed) has two mandates: maximum employment and stable prices. However, beginning with former chairman Ben Bernanke, they have included a third unwritten mandate – stability in financial markets or, as speculators have witnessed, an attempt at perpetual bubbles. And though they appear to be satisfied with their employment mandate, their unwritten mandate has led them to be paralyzed in reacting to exorbitant price instability, i.e., inflation. The “strong” labor market has contributed to wage inflation, yet lower real, inflation adjusted, wages. The green dashed line in the graph below shows real wages and salaries.

While inflation has crept higher, the Fed has kept their head in the sand and continued their pursuit of remarkably expansionary monetary policy. The Fed Funds rate has been anchored at the zero bound and QE (Quantitative Easing) persists, albeit at a slower rate. Fear of popping the greatest asset bubble in the history of asset bubbles has allowed only jawboning about monetary tightening. It appears the Fed is hoping talk will assist in a “controlled descent” in financial markets versus an outright crash. However, their procrastination has allowed the situation to become more exaggerated. Notice in the graph below from 1970 to present, the Fed has never previously allowed inflation to rise so high without a corresponding increase in the Fed Funds rate.

Martin Wolf at the Financial Times, wrote in a recent article, “Losing control over inflation is politically and economically damaging: restoring control usually requires a deep recession.” Frequent readers know I have been pointing out the Fed’s error for some time regarding their use of loose monetary policy to support increasing debt in the economy. Now, the reality that the Fed is painted into a corner is in plain view.

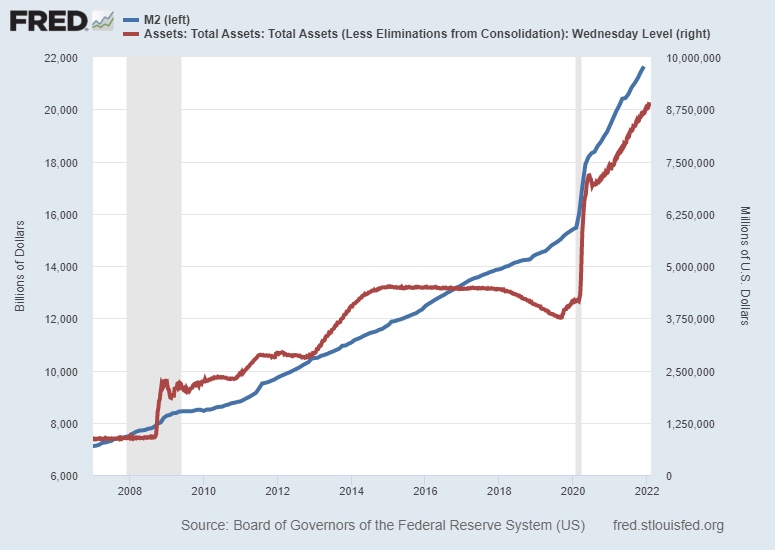

The staggering $8 trillion increase in the Fed’s balance sheet since 2007 has led to an exorbitant increase in the money supply. This, combined with supply constraints, has led to 40-year highs in inflation. In addition to fueling an asset bubble that now has the Fed petrified, the higher costs are hurting the average family. A recent article in The Wall Street Journal stated the average U.S. household is spending $276 a month more due to inflation. With the stimulus and other government transfer payments in the rear view mirror, most families are back to living paycheck-to-paycheck and cannot afford an extra $276 a month.

Although the stock market tends to anticipate and react quickly to news of policy changes, the impact on the economy is felt more slowly. As written in Martin Wolf’s article, “Given…the ‘long and variable lags’ in the relationship between monetary policy, the economy and inflation, described by Milton Friedman, it is hard to believe the Fed is anywhere near where it needs to be today. The Fed itself agrees: tightening is on the way. But the question is whether it can still contain an inflationary spiral and keep expectations stable without having to inflict recession. That is going to be extremely hard to pull off. Policymakers just do not know enough about the post-pandemic economy to calibrate the needed policy changes, especially as they are clearly too late.”

I believe the second graph above clearly illustrates the Fed is “behind the curve.” The impending crisis largely falls in their laps. Over a decade ago, the Fed stepped out of bounds by unlawfully incorporating propping up the stock market into their mandates. As the stock market grew over the past decade from slightly overvalued to a record-setting bubble, the Fed lived in denial. Now with inflation not confined solely to asset prices, the panic is becoming apparent.

Economist Stephen Roach of Project Syndicate recently wrote in his article “The Fed Is Playing With Fire,” “By now, it is passé to warn that the Fed is ‘behind the curve.’ In fact, the Fed is so far behind that it can’t even see the curve. Its dot plots, not only for this year but also for 2023 and 2024, don’t do justice to the extent of monetary tightening that most likely will be required as the Fed scrambles to bring inflation back under control. In the meantime, financial markets are in for a very rude awakening.”

The S&P 500 Index closed at 4,419 down 1.8% for the week. The yield on the 10-year Treasury Note rose to 1.95%. Oil prices increased to $93 per barrel, and the national average price of gasoline according to AAA rose to $3.49 per gallon.

© 2022. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.