Executive Summary

Historically, retirees could safely use the old “rule-of-thumb” of a 5% withdrawal rate to supplement Social Security and other defined benefits to provide income during retirement, while at the same time preserving their capital. This principle typically assumed a 60/30/10 buy-and-hold portfolio – 60% stocks, 30% safe Treasury Notes/Bonds, and 10% money market. The success of this “rule” was dependent upon three factors: 1) the stock market cycle and future performance, 2) interest rates, and 3) the amount of retirement savings. Over the past decade many advisors have reduced the estimate to about 4%. Has the latest estimate been reduced enough? In The Details, I compare those factors for someone retiring in 1983 versus today, and one will see how vastly different those times are. Given the current stock market overvaluation, the low interest rate environment, and the woefully underfunded retirement savings, many future retirees will have a serious dilemma implementing this “rule-of-thumb” and preserving capital. Now is the time for more prudent planning and astute investing, and simple rules of thumb may not be sufficient.

Please read the entire missive for details about one of the most important dilemmas facing retirees.

“If you keep your head in the sand, you don’t know where the kick’s coming from.”

–Herbie Mann

The Details

It is commonplace for people to use “rules-of-thumb” when discussing retirement. Rules-of-thumb are an easy way to summarize a complex subject. For instance, historically it was said a retiree could withdraw 5% annually from one’s retirement savings to supplement any Social Security or other defined benefits and preserve one’s capital throughout retirement. Over the past decade or so many advisors have reduced that estimate to about 4%. Has the latest estimate been reduced enough? Let’s look at an oversimplified example to see if it is applicable today.

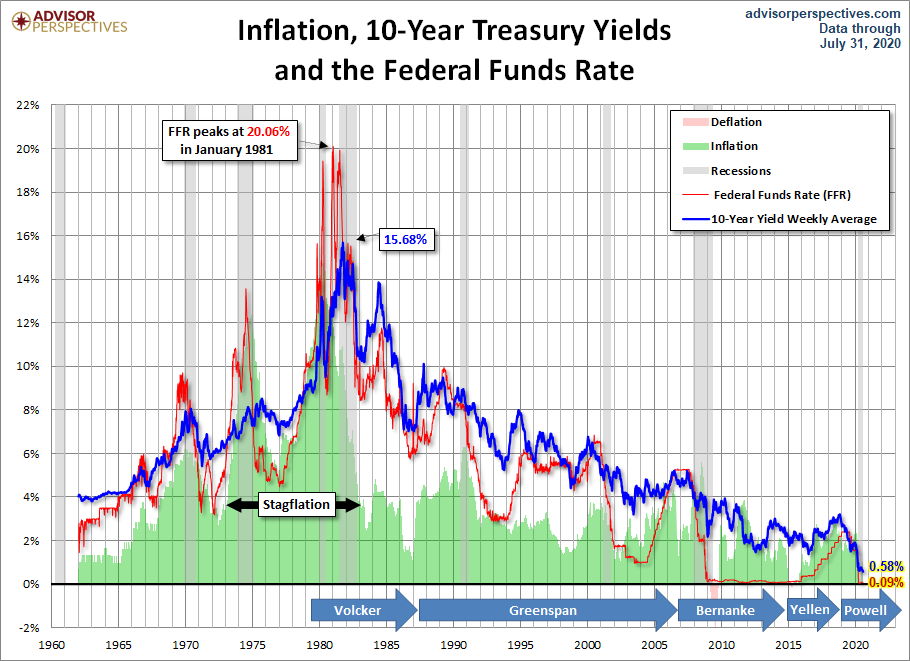

In the past, many financial advisors have used the rule of thumb of a 60/30/10 portfolio for retirees. In other words, 60 percent of the portfolio would be invested in stocks providing the ability for growth above inflation, 30 percent would be in safe Treasury Notes or Bonds providing interest income, with the remaining 10 percent in T-Bills or money market for liquidity. Let’s compare a newly retired individual today versus in 1983. 1983 was the start of a secular (long-term) bull market lasting 27 years. Interest rates on 10-year Treasury Notes and the Federal Funds Rate were over 10%. For simplicity’s sake, let’s assume the dividends on equities offset inflation. The 30-year average compounded return for the S&P 500 Index starting in 1983 was about 8% excluding dividends. Even after reducing the 10-year Treasury yield for inflation, it is easy to see how one could withdraw 5% and still preserve capital. The chart below illustrates a long-term view of the 10-year Treasury Note yield, the Federal Funds Rate, and the rate of inflation.

Today’s picture is a little more complicated. The yield on the 10-year Treasury Note is around 0.70%, and the Federal Funds Rate is effectively zero. Inflation is hovering around the 2% mark; therefore, leaving real (after-inflation) yields negative. And the Federal Reserve Bank (Fed) has indicated they have no plans to raise short-term rates. Long-term interest rates tend to track long-term economic growth. Forecasts for economic growth have been reduced due to the amount of debt in existence and will likely result in a real growth rate between 1-2% over the next decade.

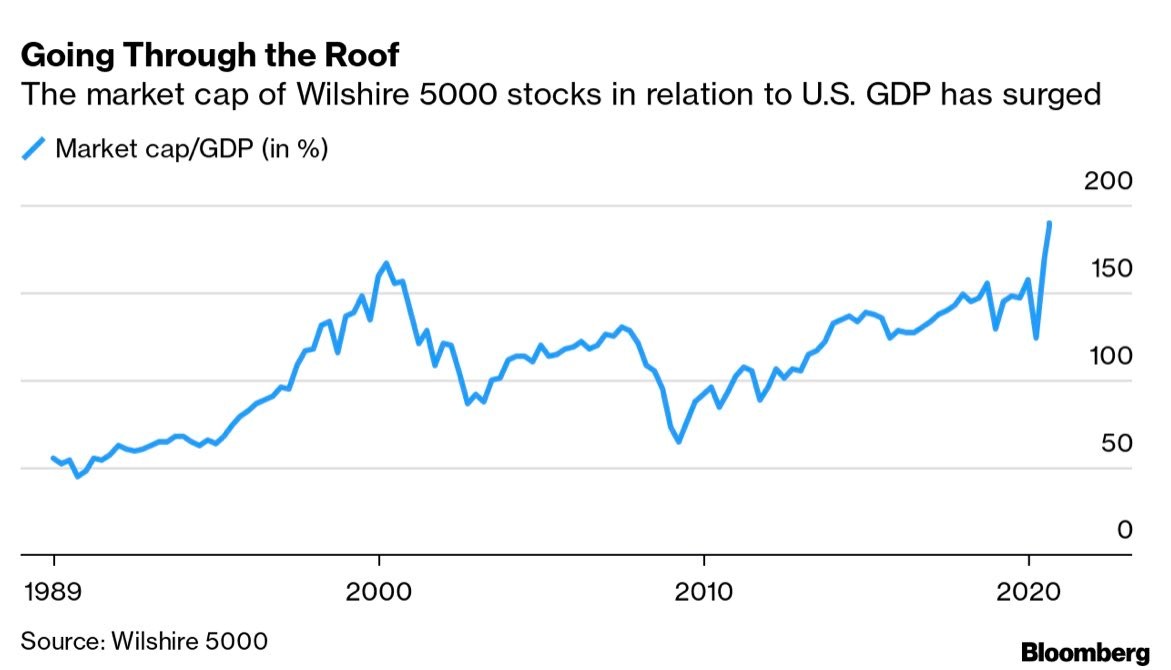

This means equities will have to carry the weight for meeting retirement withdrawals. Unfortunately, stocks are currently more overvalued than ever before in history. In fact, the Buffett indicator, total equity market cap-to-GDP, just hit an astounding 190%, dwarfing the level in the second highest bubble, the Tech Bubble ending in 2000. And this calculation indicates stock prices are almost 2.5 times above fair value as determined by the long-term average valuation. See the chart below.

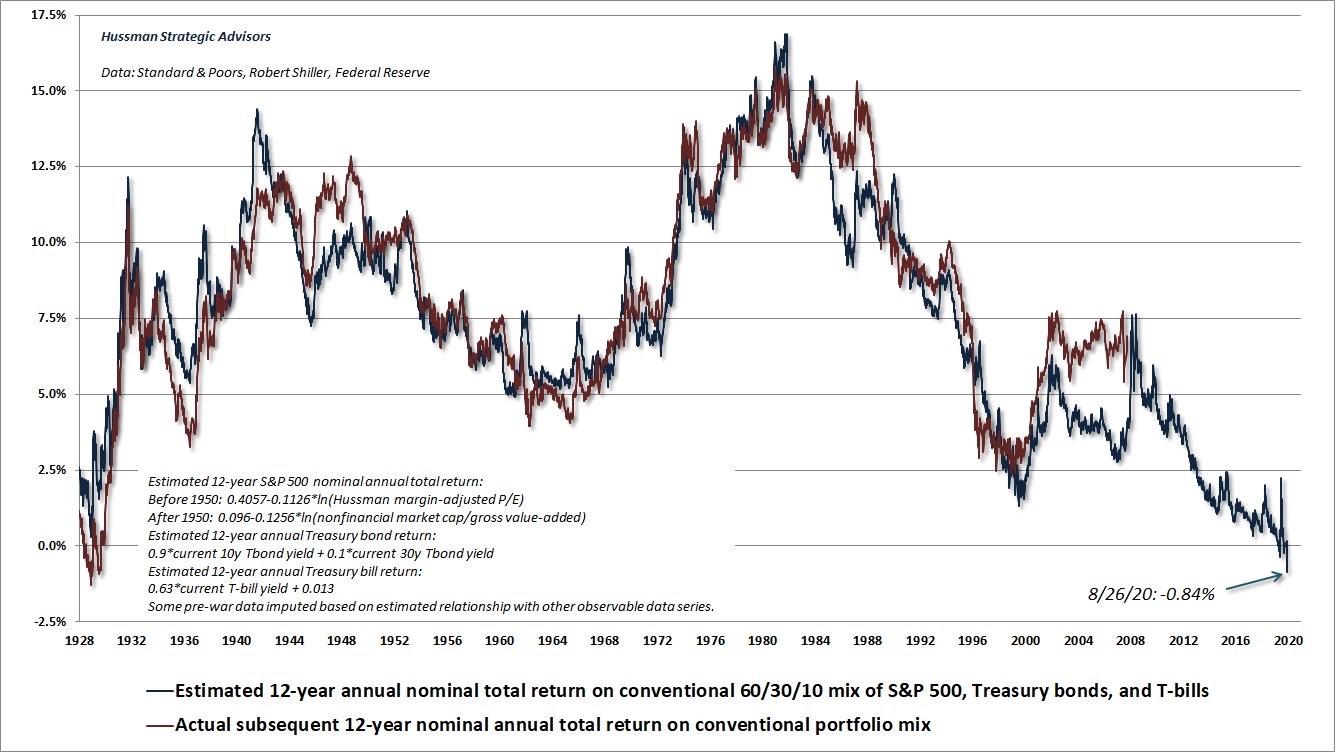

Therefore, it is more likely than not that stocks will enter a long-term or secular bear market. Secular markets can last for a decade or longer. Economist John Hussman has performed tremendous research examining actual returns based upon previous valuation levels. His chart below shows how a 60/30/10 portfolio, factoring-in current stock valuations and Treasury yields, indicates a likely result of 12-year average annual nominal (before inflation) return of -0.84% (blue line below). Now, this does not mean each year the return will be -0.84%, but the average over the period will likely be close to this number. This is based upon the historical returns and correlation with previous valuations (red line below).

The facts above indicate that both the 10-year Treasury yield and the S&P 500 will probably result in negative returns after inflation on-average over the next 10-12 years. How will a retiree be able to withdraw 4% annually and preserve capital?

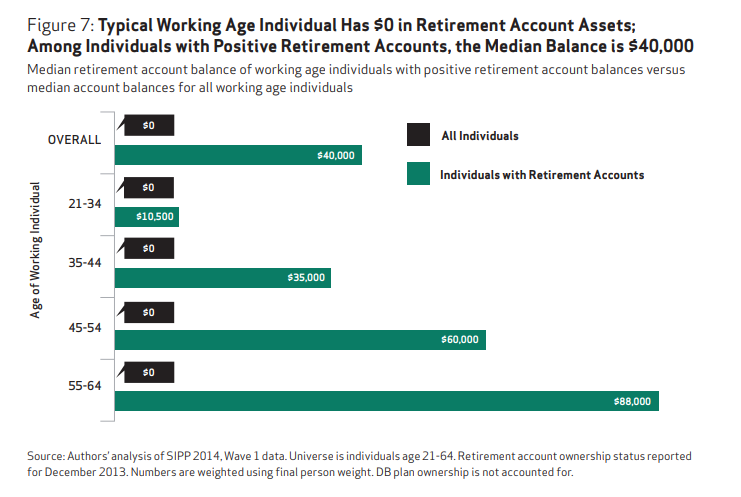

Before I answer that, let’s add one more wrinkle. As shown in the graph below, obtained via economist Lance Roberts of Real Investment Advice, the typical working-age individual has zero dollars in retirement assets. And among those with positive retirement accounts, the median balance is a mere $40,000. The median balance for the age 55-64 cohort is only $88,000.

So, even if the stock market was at the beginning stages of a secular bull market, and if long-term interest rates were above 5%, the typical retiree does not have enough saved to support oneself in retirement. This indicates the median individual will have to: 1) work longer, if possible, 2) reduce one’s expected living standard, and/or 3) spend principal combined with Social Security, hoping the principal stretches throughout one’s retirement years.

These are serious problems facing retirees today. In order to meet the retirement needs, a 4% withdrawal in a 60/30/10 buy-and-hold portfolio will likely fall short. For those with adequate savings, it will be important to manage their assets in a manner appropriate for both the current stock market cycle, and the level of interest rates now and expected in the future. For those without enough savings, many will not be able to continue working for health reasons. Thus, there will probably be calls for the Federal Government to supplement Social Security with some form of Universal Basic Income (UBI). Note, I am not advocating a UBI, merely reporting what might transpire in the future.

The retirement dilemma is real and complicated. The level of real interest rates, equity valuations, and current retirement savings have created a serious predicament. Hopefully, financial advisors recognize the picture and are counseling their clients appropriately. Those who practice “Ostrich Planning,” by sticking their head in the sand and ignoring reality, will have a tough road ahead. At Prudent Financial, we don’t practice Ostrich Planning.

The S&P 500 Index closed at 3,508 up 3.3% for the week. The yield on the 10-year Treasury Note rose to 0.73%. Oil prices increased to $43 per barrel, and the national average price of gasoline according to AAA increased to $2.23 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.