Executive Summary

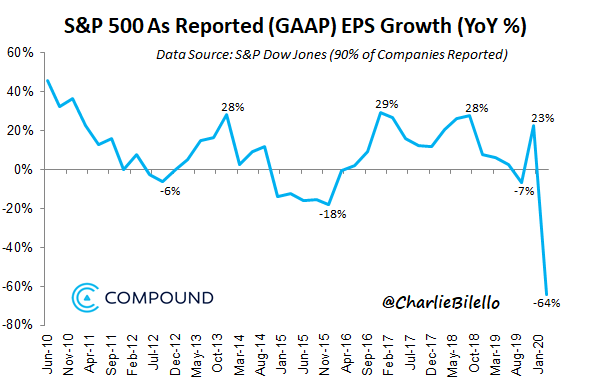

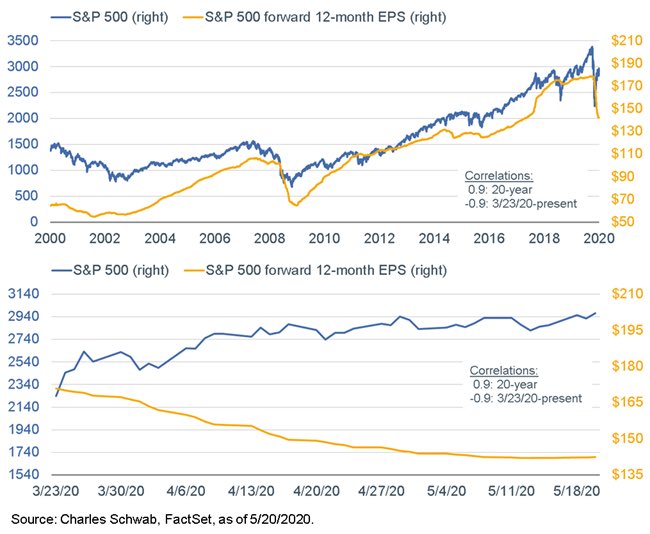

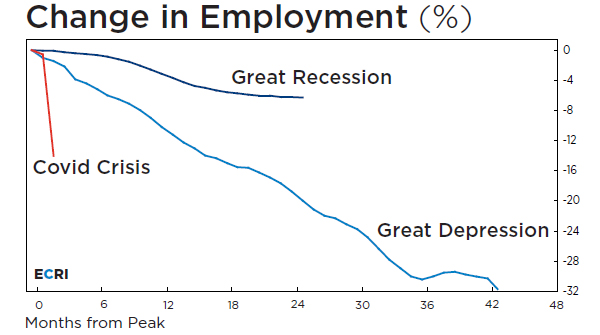

Prior to becoming the Director of the U.S. National Economic Council, Larry Kudlow hosted a financial program on CNBC where he frequently touted, “Profits are the mother’s milk of stocks.” The recent rally in stock prices pushed stock valuations to extremes last seen in February of this year. While historically corporate earnings have always been the fundamental driver of stock prices, lately it appears that dynamic has temporarily changed. The market is instead focusing on the Federal Reserve money printing. In the first graph below, one can see S&P 500 companies saw a 64% DROP in net corporate earnings for the first quarter versus the same quarter in 2019! COVID-19 will impact the second quarter of 2020 in a more drastic manner. The second graph below displays the disconnect between S&P 500 stock prices and future estimated earnings. And the massive drop in employment translates to a longer period of time for corporate profits to return. The current gap between corporate fundamentals and stock prices again creates the possibility for a trap door type of correction seen in March of this year. Currently, Fed money creation appears to be the mother’s milk of stocks.

Please proceed The Details for the complete explanation!

“There is nothing at all conservative, in my opinion, about speculating as to just how high a multiplier a greedy and capricious public will put on earnings.”

— Warren Buffet

The Details

Prior to becoming the Director of the U.S. National Economic Council, Larry Kudlow hosted a financial program on CNBC where he frequently touted, “Profits are the mother’s milk of stocks.” While historically corporate earnings have always been the fundamental driver of stock prices, lately it appears that dynamic has temporarily changed. Yet like other similar historical disconnects from fundamentals, this too will eventually end.

First, a brief primer on the relationship between stock prices and earnings. The value of a company is typically defined as a multiple of their earnings. In order to determine the “proper” valuation of a group of stocks in an index, such as the S&P 500, an examination of its price-to-earnings ratio is performed. There are a number of derivations of this ratio including the following (list is not all-inclusive): price-to-trailing 12-month net earnings, price-to-estimated forward earnings, and price-to-trailing 10-year average inflation-adjusted earnings (known as the Shiller P/E or CAPE – Cyclically Adjusted P/E). The latter, Shiller P/E provides a better indication of future long-term returns due to the fact that it attempts to eliminate the fluctuations arising from the business cycle.

Today, Tuesday, appears to be Groundhog Day, as CNBC is proclaiming the same justification for soaring stock prices as last Monday, only a different company. Last Monday excitement stirred around the potential for a COVID-19 vaccine stemming from an early Phase I trial from Moderna; today, it is an early Phase I trial from Novavax. Seriously, you can’t make this stuff up. I guess early Phase I trial stock market pumps are the new “Phase I trade deal is near!”

Let’s dig into corporate earnings to see if soaring stock prices are justified. Remember, the economy was already slowing during first quarter of 2020 even before COVID-19. In fact, the virus only impacted a few weeks in the final month of the quarter. So, one might expect a slight dip in earnings with the larger plunge coming in the second quarter. The following graph illustrates that first quarter 2020 net earnings for the S&P 500 fell 64% versus the first quarter of 2019. 64%!

Some might argue that the stock market is “looking through” this bad quarter and pricing in good times to come. Although I am not a fan of the forward P/E ratio because earnings estimates seem to be overly optimistic more often than not, below is a chart from Liz Sonders, Chief Investment Strategist at Charles Schwab, showing the S&P 500 versus forward earnings estimates. (Note the S&P 500 blue line should reference the left side of the charts.) The lower graph displays the correlation between the S&P 500 and forward earnings estimates from the time COVID-19 began to impact the economy. Since then earnings expectations have plummeted while the S&P 500 has risen.

And, the Shiller P/E ratio has risen back to 28.3, or 79% above its long-term median. And this is before the plunge in corporate earnings has had a significant impact on this ratio.

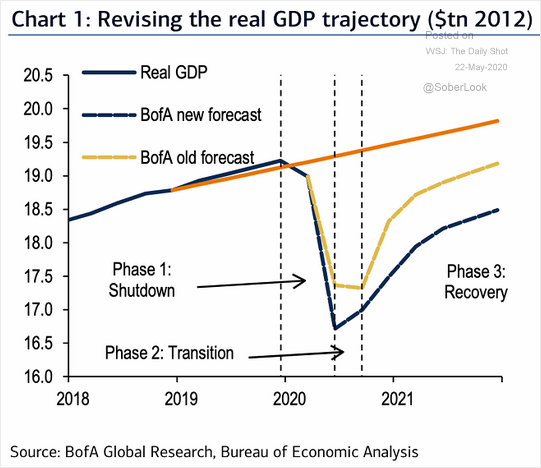

In order to believe the current stock market price is justified, one must believe that earnings are going to bounce back above where they were at the peak in February. The reason I say “above” is because the market was significantly overvalued by almost all valuation measurements pre-COVD-19. For earnings to jump, the economy must also bounce back. The chart below shows the changing downward projections of economic growth by Bank of America. Though some bump off of the bottom is to be expected, this chart does not show a return to 2019 levels of GDP anytime soon.

A significant contributor to falling GDP is the massive drop in employment. The following graph is from the Economic Cycle Research Institute. Note the trajectory of employment losses versus the Great Depression.

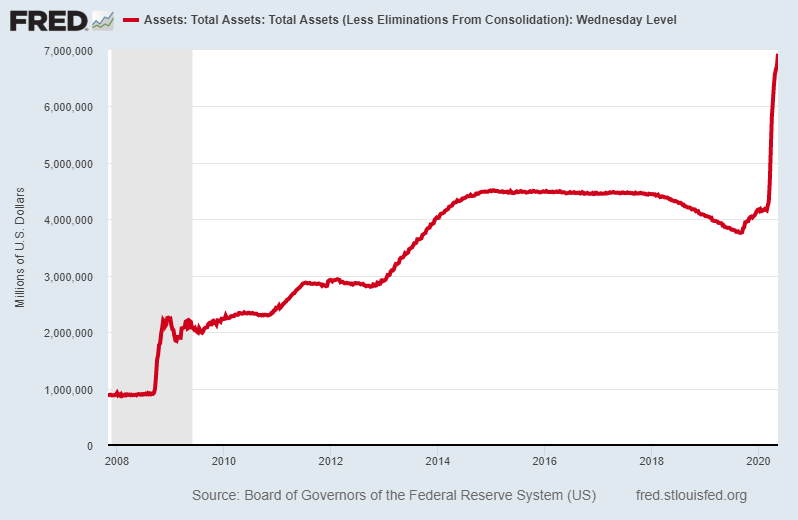

It should be apparent that currently “profits” are not the mother’s milk of stocks. The mother’s milk of stock is Fed money creation. The chart below illustrates the colossal increase in the Fed’s balance sheet since this crisis began, shown by the near-vertical line.

The Fed is giving investors the false impression it can resolve the current crisis by printing trillions of dollars leading to massive debt funding. The “Don’t fight the Fed” mantra is currently intact. However, once the debt defaults increase, earnings forecasts drop further, and bankruptcies soar, investor sentiment could change quickly. At that point, with nothing fundamental supporting the market, it will be like opening a trap door. The extent stocks need to fall to garner the attention of value investors is staggering.

A brief listing of some of the recent bankruptcy filings include: Frontier Communications, Golds Gym, J. Crew, Neiman Marcus, True Religion Apparel, Virgin Australia, Hertz, and JC Penney just to name a few. Expect this list to grow substantially.

One would expect when earnings plunge, stock prices would also fall. However, investors are tethered to the belief that the Fed is creating trillions in new money, so profits or losses do not matter. The Fed is directly creating a wider gap between stocks and underlying earnings. This gap will eventually be filled. The larger the bubble grows, the greater the ensuing correction. It might take the crisis morphing, to a greater degree, into the financial system through debt defaults before investors see the light. In the meantime, be careful because the Fed can only provide “mother’s milk” to stocks for so long before reality strikes.

It looks like Larry Kudlow does have it wrong, at least for now.

The S&P 500 Index closed at 2,955 up 0.87% for the week. The yield on the 10-year Treasury Note rose to 0.66%. Oil prices increased to $33 per barrel, and the national average price of gasoline according to AAA rose to $1.96 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.