Executive Summary

Stock market hype or the stock market cycle, which is more important? As I have written many times before, the financial media is biased toward a positive (hype) slant – even if it means picking individual data points while ignoring the overall picture of the market cycle. For instance, the news regarding President Trump’s meeting with China’s president focused on positive hype even though nothing really changed. Much of the corporate data on earnings point to lower results as well as a decline in manufacturing activity. The financial data does not support the stock market highs being hyped in the media. Please proceed to The Details to remind oneself of the importance of the market cycle.

The Details

It seems lately the “hype” is attempting to reach “all-time highs.” Those who listen to financial media understand the excitement exuded by pundits when they are able to proclaim: “the best start to a year since Adam and Eve.” However, they conveniently exclude the fact that last December was the worst December in the history of the stock market. Last week it was exuberance over the best June since the 1950’s. Of course, they left out that May was the worst may since the 1970’s.

Cherry-picking data-points and attempting to focus on the short-term minutia instead of the “Cycle” will leave many investors suffering regret. Over this past weekend, President Trump met with China’s President Xi Jinping at the G-20 meeting in Japan. After the meeting the excitement of a “Trade Truce” couldn’t be contained. What exactly is a Trade Truce? It means, overall, the status quo! Nothing really changed. The U.S. agreed not to implement increases to existing tariffs – meaning they remain where they were. No real resolution, yet the futures markets were completely giddy.

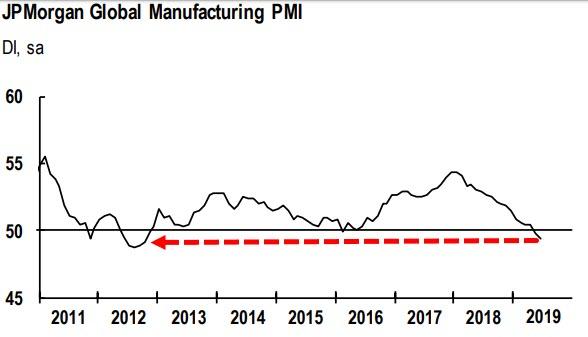

- China Manufacturing PMI flat at 49.4 in JUN

- Japan Manufacturing PMI ticked down to 49.3 in JUN from 49.5 in MAY

- Eurozone Manufacturing PMI ticked down to 47.6 in JUN from 47.7 in MAY

- Australia Manufacturing PMI ticked down to 49.4 in JUN from 52.7 in MAY

- Russia Manufacturing PMI ticked down to 48.6 in JUN from 49.8 in MAY

- Indonesia Manufacturing PMI ticked down to 50.6 in JUN from 51.6 in MAY

- Taiwan Manufacturing PMI ticked down to 45.5 in JUN from 48.4 in MAY

- South Korea Manufacturing PMI ticked down to 47.5 in JUN from 48.4 in MAY

- South Korean Exports decelerated to -13.5% YoY in JUN from -9.5% in MAY

- 18 of 497 S&P 500 constituents have reported Q2 earnings thus far with EPS growth tracking down -18.3% YoY on an aggregated basis and every sector in the red

© 2019. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.

Want to learn more about our Insurance strategies?

Set up a time to chat with us.