Executive Summary

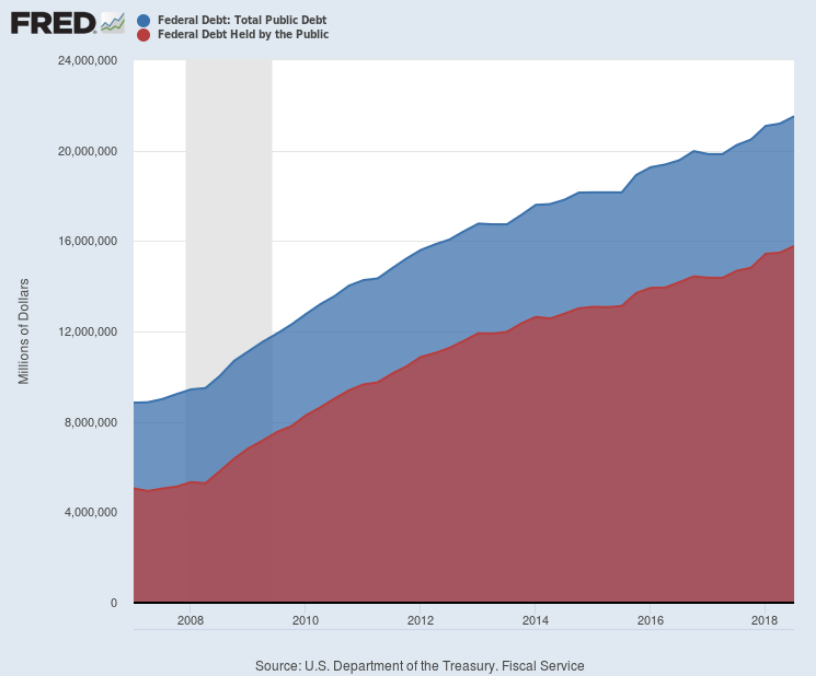

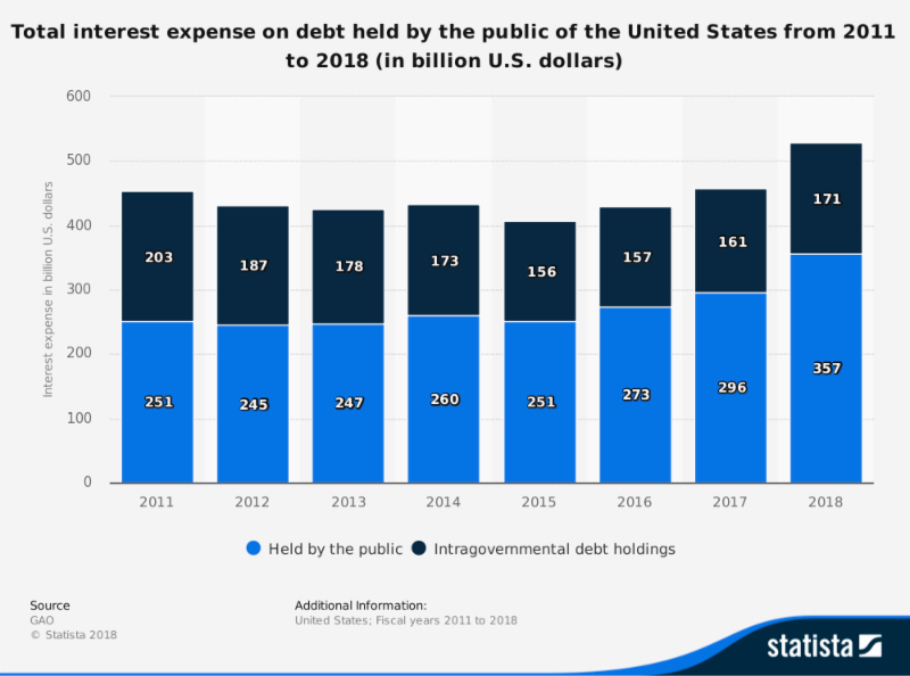

Presently, the average Joe and Jane have no idea they are living in a Potemkin Village. After the 2008 Financial Crisis, global monetary experiments were implemented to “save” the economy. The economic “recovery” resulted in a decade of 2% average real GDP growth, 36 percent below the long-term average. Simultaneously creating a massively overvalued stock market which is over two standard deviations above the mean, and record debt levels. Three of the central banks of the world participated in the money printing experiment to the tune of about $14 trillion. The booming recovery never materialized, and the business cycle will complete as always. However, a new wing will be added to the Potemkin Village if certain politicians and economists get their way. Many are floating an old idea with a new name: Modern Monetary Theory (MMT). The gist of MMT is government can spend whatever they want since they can always print money. See below for more on this doomed-to-fail proposition.

“And thus I clothe my naked villainy with odd old ends stol’n out of holy writ; And seem a saint, when most I play the devil.”

– William Shakespeare, Richard III

The Details

And, stock prices are currently over double their long-term mean. See below.

It should be quite evident what benefited the most from the Fed’s dropping interest rates to zero percent and creating just under $4 trillion in new reserves out of thin air, through their Quantitative Easing programs. Economic growth only received short-term sugar-boosts which soon faded, while the stock market, by some measures, reached the most over-valued bubble in history. A quick note on economic growth, the following graph from the Atlanta Fed shows their GDPNow model is predicting first quarter 2019 annualized growth at 0.4%.

The S&P 500 Index closed at 2,822, up 2.89% for the week. The yield on the 10-year Treasury note fell to 2.59%. Oil prices increased to $59 per barrel, and the national average price of gasoline according to AAA rose to $2.55 per gallon.

Bob Cremerius, CPA/PFS

© 2019. This material was prepared by Bob Cremerius, CPA/PFS, of Cremerius Wealth Management, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Cremerius Wealth Management is not affiliated with First Heartland Capital, Inc.

Want to learn more about our Insurance strategies?

Set up a time to chat with us.