Executive Summary

The stock market is setting a record today on more “hopes and dreams” and supported by cheers from financial media and politicians. Unfortunately, the economic data is diametrically opposed to the stock market moves. Below I summarize a smattering of economic data from a number of different sources in order to shed light on this absurdity. Someday reality will appear with a vengeance, despite the cheerleaders.

“Beware lest you lose the substance by grasping at the shadow.”

— Aesop

The Details

This morning, Monday, the stock market opened in “record” territory. The President even entered the role of stock analyst predicting a “good day” for the stock market. All of this would lead many investors to assume a resurgence in strong corporate profit and economic growth is on the cusp. Unfortunately, none of that is true. Financial media’s justification for the “record-setting” morning market move was once again, “hope” for a China trade deal and general FOMO (fear of missing out) on more upward movement in the most overvalued market in history. I thought this might be a good day to highlight some of the economic and earnings data released recently.

First some reports announced today by Danielle DiMartino Booth, founder of the economic consulting firm Money Strong, LLC, and former advisor to the Federal Reserve Bank of Dallas President Richard Fisher.

“Texas Manufacturing Outlook Survey ‘New orders index turned negative for 1st time in 3 years, falling 11 to -4.2. The growth rate of orders index fell into negative territory, at -5.9. The capacity utilization index retreated from 12.0 to 3.6, a 3-yr low.’”

“We[‘ve] been seeing some rumblings in the riskiest credits – the CCCs. We’ve seen some leveraged loans go bad. These are not the types of announcements you would anticipate seeing in a non-recessionary climate.” via BNN

“China’s Industrial Profit Widens Drop on Economy, Deflation. ‘The larger slide in September (-5.3%) was due to a faster decline in industrial product prices and a slower growth in sales.’ Diminishing returns of stimulus measures.”

“Survey: US business hiring falls to a 7-year low ‘Just one-fifth of economists surveyed by NABE said their companies have hired workers in the past 3 months, down from 1/3 in July. Job totals were unchanged at 69% of companies, up from 57% in July.’”

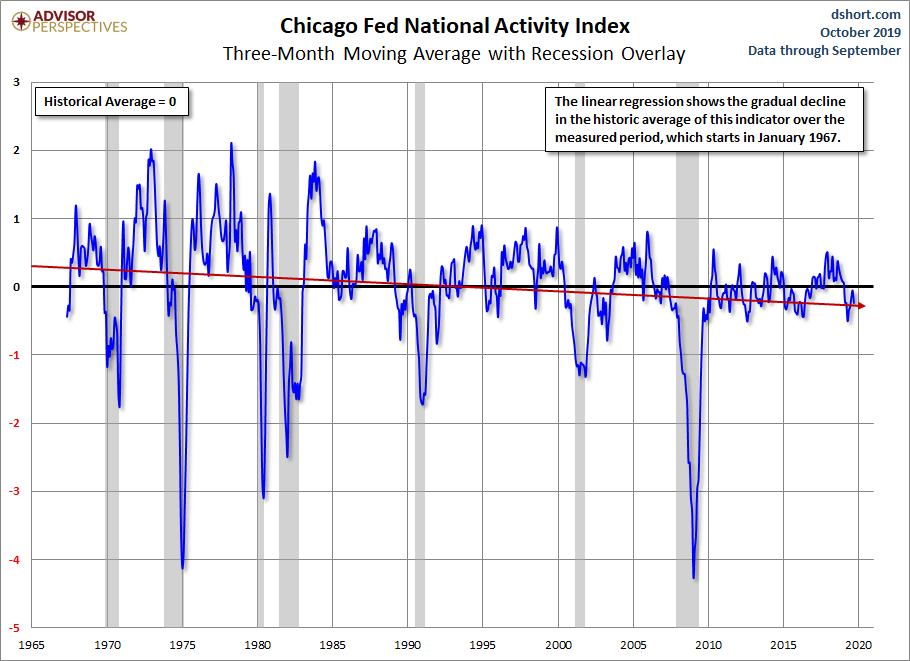

From the Chicago Fed National Activity Index, “Index points to slower economic growth in September. Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) fell to -0.45 in September from +0.15 in August. Three of the four broad categories of indicators that make up the index decreased from August, and all four categories made negative contributions to the index in September. The index’s three-month moving average, CFNAI-MA3, decreased to -0.24 in September from -0.06 in August.”

As stated on the Advisor Perspectives website, “The Chicago Fed’s National Activity Index (CFNAI) is a monthly indicator designed to gauge overall economic activity and related inflationary pressure. It is a composite of 85 monthly indicators as explained… on the Chicago Fed’s website. The index is constructed so a zero value for the index indicates that the national economy is expanding at its historical trend rate of growth. Negative values indicate below-average growth, and positive values indicate above-average growth.”

Economist David Rosenberg of Gluskin Sheff, “US trade data just came out and showed the damage already wrought…exports are down 3% YoY while imports have shrunk 4.6%.”

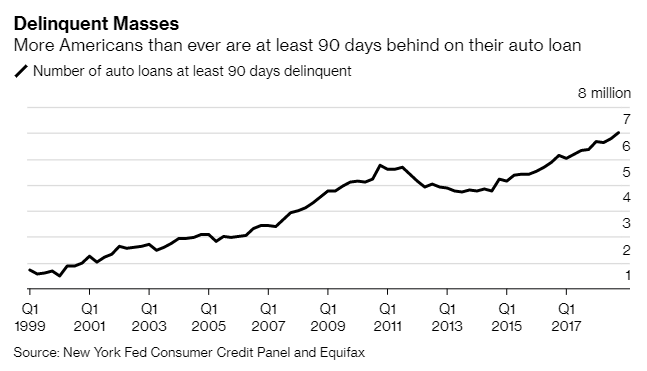

Auto loan delinquencies are soaring.

Nobel Laureate economist Professor Robert Shiller “I see bubbles everywhere.” Shiller predicted both the Tech Bubble crash in 2000 and the Housing Bubble crash in 2007.

Goldman Sachs, “today’s inventory data was weaker than our previous assumptions. We lowered our Q3 GDP tracking estimate by two tenths to +1.4%.”

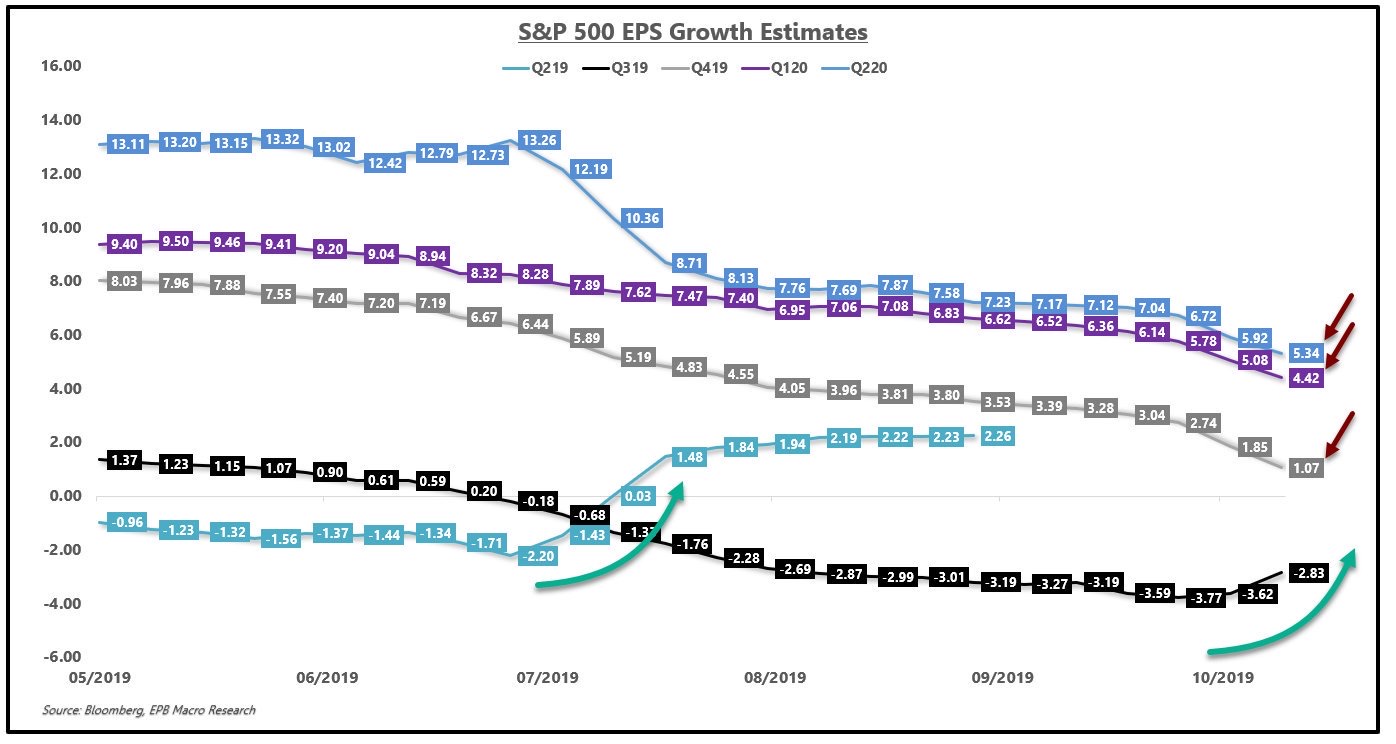

With only 200 of the S&P 500 companies reporting, Hedgeye Risk Management, LLC reports that year-over-year Q3 earnings have fallen by 0.51%. This number is mainly supported by interest sensitive companies in the Utility and Communication Services sectors, with Materials leading the plunge so far down 22% YoY.

And from the Global Macro Monitor, “Stock valuations are at record highs and the markets are so, so gummed up and distorted by government intervention, mainly from the Fed — the ultimate socialism, in our book — that policymakers and market analysts have lost their compass and can’t tell true north from south, east from west or front from back. The cheerleaders were out in full force with their pom-poms this week, by the way.”

Economist Michael Pento in an interview with Greg Hunter on USAWatchdog.com,

Pento explains, “So, the Fed changed their mind, panicked, the Fed panicked…”

“They not only stopped raising rates, they now cut rates twice, and they are going to cut rates again at the end of this month. They are also fully back in a massive QE. They have a $130 billion revolving repo facility shoving $130 billion every night, rolling it over, trying to re-liquefy the banking system and back into QE–$60 billion per month. At the peak, it was $85 billion. So, they are almost back to the peak of QE (during the Great Recession). They did not scale in, the Fed went to $60 billion right away.”

Why the sudden burst of money printing when we are being told the economy is fine?

Pento says the Fed is panicking to stop a “depression.” That’s right, a depression.

Pento contends,

“I am on record saying given the extent of the asset bubbles that we have today … household debt is at a record high. Corporate debt is at a record high, up 60%. The national debt was $9 trillion prior to the Great Recession and is now $23 trillion. Total non-financial debt is now $53 trillion, and it was $33 trillion prior to the Great Recession…

Given all these imbalances and deformations, the Fed knows we are not going to have some mild recession. If they don’t re-liquefy the money markets, the same thing that happened back in 2008 would happen today, only the stock market was only at 100% of GDP and today it is 150% or one and a half times the economy. So, the plunge in the stock market would be huge and from a much higher level. Back in the Great Recession, unemployment claims spiked. We had millions of people laid off, and the same thing would happen today only it would be much worse.”

The New York Fed’s economic growth model (Nowcast) for the fourth quarter 2019 is estimating 0.92% growth.

The outlook, for fourth quarter 2019, Q1 and Q2 2020 S&P 500 earnings growth rates, continues to tumble:

The hopes and dreams propping up stock prices to record levels while real economic data plunges to recessionary levels should reveal the temporary nature of the grand illusion presented by the financial media, politicians and other cheerleaders. The conditions are not unlike other bubbles at peak absurdity. Reality will eventually appear with a vengeance, despite the cheerleaders.

The S&P 500 Index closed at 3,023 up 1.2% for the week. The yield on the 10-year Treasury rose to 1.80%. Oil prices increased to $57 per barrel, and the national average price of gasoline according to AAA fell to $2.61 per gallon.

© 2019. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.

Want to learn more about our Insurance strategies?

Set up a time to chat with us.