Executive Summary

In September 1981, the yield on the 10-year Treasury Note peaked at around 15.8%, and the annual inflation rate was about 10.8% resulting in a “real” (after inflation) rate of about 5%. Today, the 10-year Treasury is yielding about 1.40%, and inflation in November rose 6.9% pushing real rates down to an unbelievable -5.5%. Long-term interest rates tend to track economic growth, while short term rates are set by the Fed -who recently announced three potential interest rate hikes in 2022. However, since the Federal government stimulus plans have ended and because of the massive debt loads (third graph), economic growth will likely return to their subpar trend. The Fed also has stated they will end their bond purchases (QE) by the end of March 2022. The stock market is currently providing a glimpse of what could be ahead as volatility has increased with the Fed reversing course. Any hike in short-term rates will more than likely be short-lived, and “real” long-term rates will probably remain negative. Risk-averse savers continue to suffer.

Please proceed to The Details for an explanation of the relationships to watch moving forward.

“A lower interest rate doesn’t make a debt go away.”

–Dave Ramsey

The Details

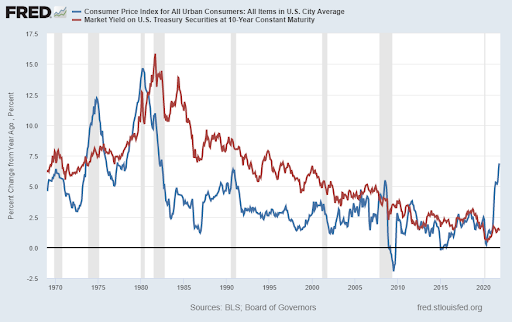

In September 1981, the yield on the 10-year Treasury Note peaked at around 15.8%. Inflation at the time was running at an annual rate of about 10.8%. Today, the 10-year Treasury is yielding about 1.40% and in November, the year-over-year change in the Consumer Price Index (CPI) was 6.9%. The graph below shows 10-year Treasury Note yields and inflation as defined by the CPI since 1969.

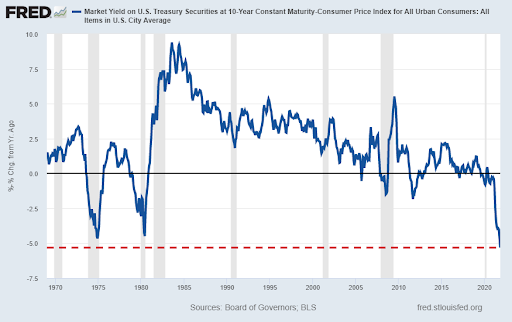

To find out the “real” yield on Treasuries, subtract the inflation rate from the nominal yield. The chart below shows the real yield at the nominal peak in interest rates (1981) was about 5%. A year prior, in 1980, inflation was much higher, and yields were much lower resulting in a negative yield of close to -5%. Amazingly, the latest CPI numbers pushed the current negative yield even lower to -5.5%.

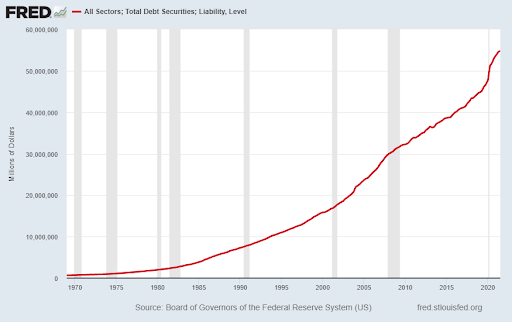

If inflation were to remain at this level, the yield on a 10-year Treasury Note would effectively be losing about 5.5% in purchasing power annually. With yields so low and inflation surging, many are calling on the Federal Reserve (Fed) to raise interest rates. The Fed, however, can only raise short-term rates as long-term rates are set by the bond market. The Fed announced at its last FOMC (Federal Open Market Committee) meeting, they would likely raise short-term rates three times during 2022. While it is possible that they will follow through on this plan, the following graph provides $54.8 trillion reasons why I do not believe they will be able to achieve such a goal. In my estimation, one or maybe two hikes are likely. However, these hikes will more than likely lead to troubles forcing the Fed to reverse course.

The graph of debt above includes debt securities from all sectors. Notice the tremendous increase in the amount of debt from 1980 to present. With interest rates on many loans tied to variable rates which are indexed to a short-term index, any increase in short-term rates will wreak havoc in the debt markets.

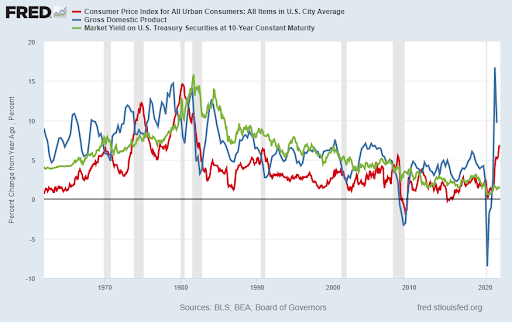

Long-term interest rates tend to track economic growth. Although in the very short-run economic growth has soared, it is important to put this growth into context. The jump in growth is mainly due to low “base effects” or low prior year comparisons, and to the massive amount of stimulus funds provided by the Federal government. The stimulus plans have run their course with the refundable child tax credit ending last week and expectations looking bleak for extending these and other benefits.

The trend in GDP growth since 1980 has been downward mostly due to the upward trend in debt. As the stimulus wears-off, I expect economic growth to return to sub-par growth. The lower growth and heavy debt loads will keep a lid on long-term interest rates. It is very possible we see negative long-term rates for years to come. The following graph compares inflation (red line), GDP growth (blue line), and the 10-year Treasury yield (green line).

Everyone realizes that interest rates are low, but many do not realize just how negative they are presently. The Fed has painted themselves into a corner with high inflation, near-zero percent interest rates, growth slowing, massive debt, and the stock market in the largest bubble in its history. After fueling this bubble for over a decade, it appears they are beginning to realize there is no way out.

The Fed has stated they will end their bond purchases by the end of March 2022 and will raise short-term rates three times next year. The stock market is currently providing a glimpse of what could be ahead as volatility has increased. The market has experienced a number of large “selling” days over the past week. I expect the Fed to change their plans should the market sell-off 20% or more. Any hike in short-term rates will more than likely be short-lived, and “real” long-term rates will probably remain negative. Risk-averse savers continue to suffer.

The S&P 500 Index closed at 4,621 down 1.9% for the week. The yield on the 10-year Treasury Note fell to 1.40%. Oil prices decreased to $71 per barrel, and the national average price of gasoline according to AAA dropped to $3.31 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.