Executive Summary

It is often said that a picture is worth a thousand words. Thus, this week’s missive has fewer words than normal and more pictures (please scroll through 1600’s to current). Understanding history and the historical patterns of bubble manias is important to preparing for 2021. The Great Depression was preceded by the roaring 20’s created bubble, and the Technology Bubble followed the 1990’s market run up. All bubbles end the same. The current market bubble may not pop immediately, but the risk is there. Just look at the fourth and fifth graphs below for Apple and Tesla stock prices. To all of our readers, we wish you a Happy New Year!

Please proceed to The Details.

“The easiest way to visualize manias is to think of a crowd which, the larger it becomes, the bigger the crowd it draws.”

–Peter Atwater – via Twitter

Throughout history, market cycles have led to manias just before their peak. The quote above provides a great explanation of a mania. Economist Lance Roberts of Real Investment Advice recently wrote, “The repeated rounds of liquidity, interventions, and accommodative policies have trained investors to take on more ‘risk.’ Such was the point we recently discussed in ‘Moral Hazard.’

‘What exactly is the definition of “moral hazard.” It is the lack of incentive to guard against risk where one is protected from its consequences, e.g., by insurance.’”

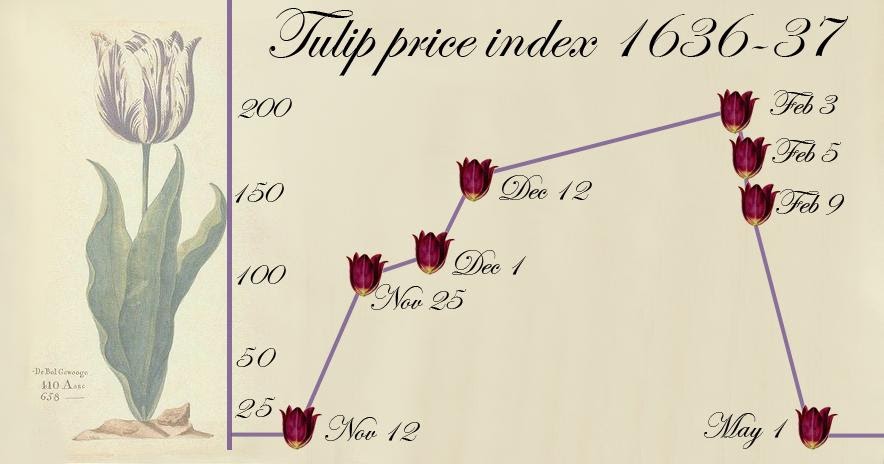

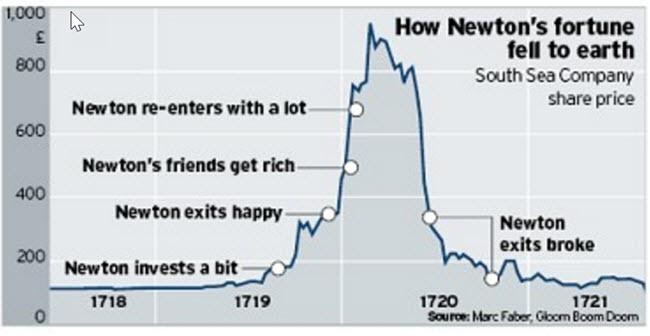

This behavior accelerates as bubbles approach their top as “smart money” or professional advisors begin to hedge or withdraw from markets while retail speculators jump in full force. The results are astronomical ascents followed by enormous descents. Following are a few graphs showing the results of prior manias beginning with Tulip Mania in the early 1600’s. This was followed by the South Sea Company Bubble in the early 1700’s.

The following illustrates the stock price of Juniper Networks. Notice the mania and plunge during the Tech Bubble / crash (1999 – 2002). The stock peaked at over $200 a share in 2000 and has not seen $50 in any subsequent year through today.

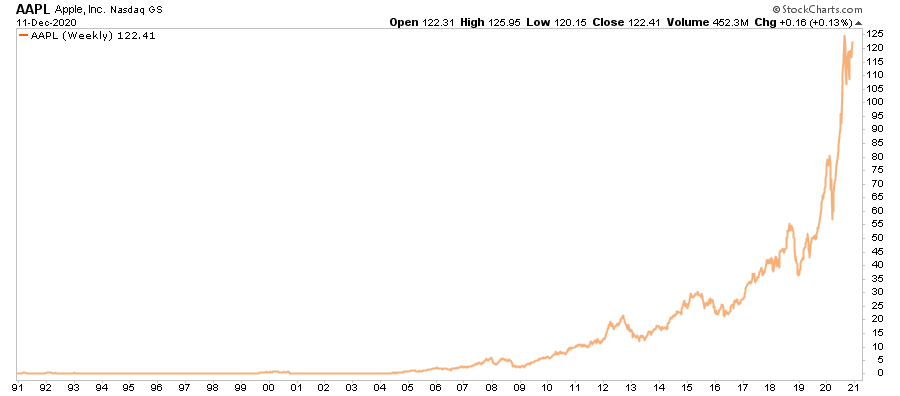

Here are a couple examples (via Lance Roberts) of companies currently trading at unjustifiable levels. First Apple which has seen little revenue growth over the past five years yet look at the rise in the stock price.

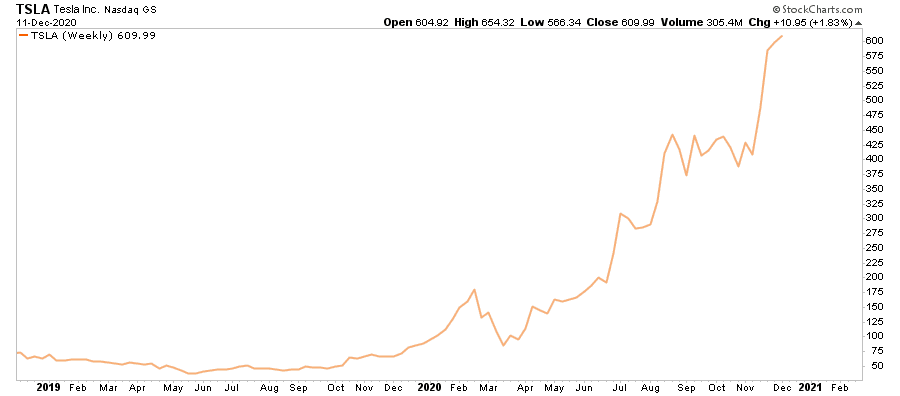

And the most ridiculously priced stock today (in my opinion), Tesla. Tesla will never produce profits to justify their current stock price.

Bubblemania has now spread to almost every equity index. The next bear market will be a wake-up call to young Robinhood traders. Economist John Hussman puts it like this, “…people think I’m kidding about the 60-70% bit [expected future drop in the S&P 500], because they don’t remember my 83% downside projection for tech in 2000.” To clarify, in 2000 Hussman predicted technology stocks would eventually plunge about 83%. To that end, the NASDAQ 100 (Tech index) fell an eerily precise 83%.

Starting 2021, it is important to take into consideration the record overvaluations in stock prices. The assertion by speculators is the Fed can keep stock prices going up forever. The belief in a “permanently high plateau” for stock prices was first stated by Economist Irving Fisher three days before the Great Stock Market Crash of 1929. It also existed during the Tulip Bulb Bubble in the early 1600’s, the South Sea Company Bubble which led to Sir Isaac Newton going broke in the early 1700’s, and the Tech Bubble of the late 1990’s early 2000’s which devastated a whole generation of investors. The outcome for manias and bubbles has always been the same, a reversion to the mean. Or said differently, a significant bear market resulting in stock prices returning to reasonable levels based upon underlying fundamentals.

The Fed might be able to delay the reversion a little longer. But the ultimate outcome will likely be the same, only worse. Because this time the mania in stocks has led to an even greater bubble. Be vigilant in this new year! And a Happy New Year to all!

The S&P 500 Index closed at 3,756, up 1.4% for the week. The yield on the 10-year Treasury Note fell to 0.91%. Oil prices increased to $49 per barrel, and the national average price of gasoline according to AAA rose to $2.26 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.