Executive Summary

The onset of COVID-19 led to business lockdowns and an abrupt halt to economic activity. Through the CARES Act several programs were implemented to assist with unemployment benefits due to government mandated shutdowns. However, many of these are expected to expire on December 26. Currently there are over 20 million people on some form of government unemployment benefit. Another “benefit” of the CARES Act, which is really a brewing storm, is the moratorium provided to mortgagors and renters. This benefit was a deferral not a relief from having to pay. According to an article quoted in The Details, Moody’s analytics forecasts that 16% of all renters will face eviction by January 2021. Many are using credit cards to make those payments in the absence of income or government help. As Scott Minerd said, we are just in the eye! Further stimulus will only widen the eye, delaying the other side of the storm.

Please proceed to The Details.

“When you are in the eye of the storm, you are often not aware of the whiplash around you.”

–Hugh Bonneville

The Details

The onset of COVID-19 led to business lockdowns and an abrupt halt to economic activity. The dominos began to fall. Unemployment skyrocketed, incomes plummeted, and spending slowed. In order to assist laid-off workers, the Federal Government implemented several new unemployment benefit programs to supplement and add to existing state programs. Through the CARES Act the Pandemic Unemployment Assistance (PUA) program offered assistance to those otherwise ineligible for state benefits. This includes the self-employed and contract workers. The PUA benefits last for 39 weeks. The Pandemic Emergency Unemployment Compensation (PEUC) program provided an additional 13 weeks of benefits for those who have exhausted their state benefits. All of these are expected to expire on December 26.

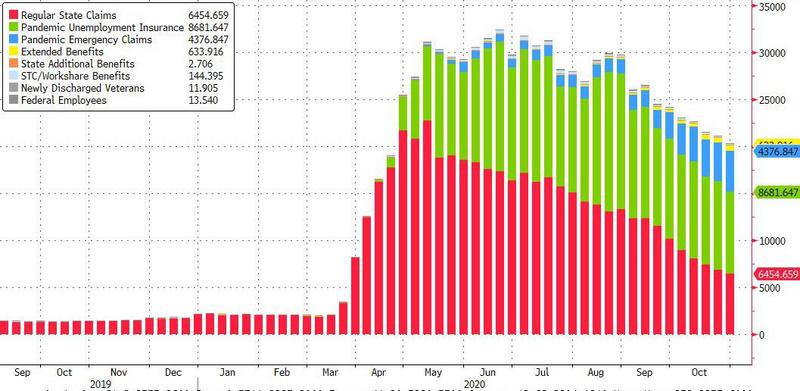

Most state unemployment programs offer benefits for up to 26 weeks. Currently, there are over 20 million individuals receiving some type of unemployment benefit. About 13.7 million are receiving benefits beyond what is offered by state programs. This is over 10 times higher than the 1.25 million unemployed for over 27 weeks in October of last year. A back of the envelope calculation dividing the 20 million plus another 3 million not eligible or who have already rolled-off benefits, by the labor force of 160.9 million per the BLS monthly employment report, gives an unemployment rate over 14%. This is much higher than the “official” unemployment rate of 6.9%. See the graph below from Zero Hedge illustrating the various recipients of unemployment benefits.

The decline in the graph from the June peak represents a combination of employees re-hired, and those who are no-longer eligible for benefits. With over 14% of the labor force receiving unemployment compensation and several million more no longer eligible, it is fair to deduce that household incomes have fallen. To supplement incomes and provide temporary relief, the CARES Act provided stimulus payments of $1,200 and provided forgivable loans to small businesses under the Paycheck Protection Program (PPP). The intent of the PPP was to allow employers to pay their employees, even if they were not actively working due to the pandemic.

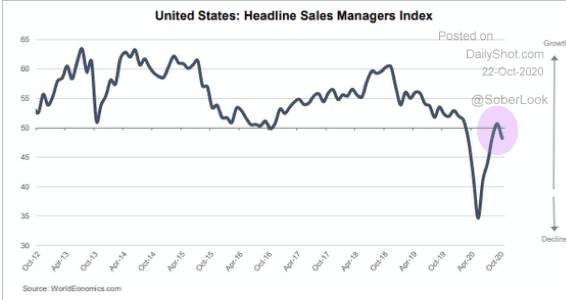

These stimulus plans provided a short-term boost to the economy; however, they are now substantially exhausted. Calls for more stimulus have come from all directions, including the Federal Reserve Bank. Being an election year with contested results and still an uncertain makeup in Congress, further stimulus plans have come to a halt. With enormous unemployment and no more Federal support, the damage is again visible in the economy. See the chart below from Patrick Hill via Real Investment Advice. Notice the bounce from the bottom due to stimulus plans and now the turn back downward.

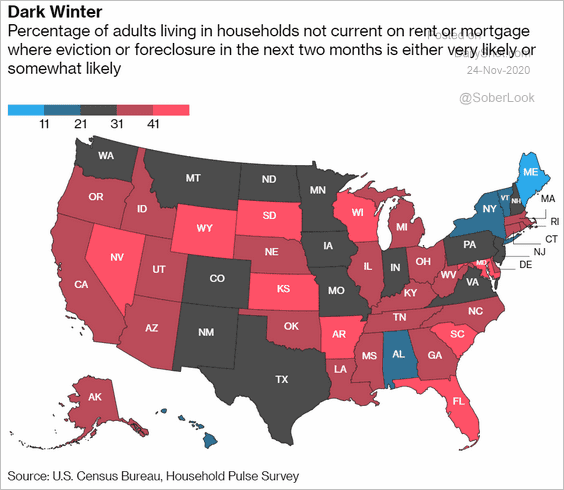

Another “benefit” of the CARES Act, which is really a brewing storm, is the moratorium provided to mortgagors and renters. These programs allowed homeowners and apartment buildings with Federal loans to defer payments through July 31. As written by Patrick Hill, “In mid-August, President Trump signed an Executive Order instructing the Centers for Disease Control and Prevention to identify households where infections may increase and mandate that household members be protected from eviction to ensure public safety. Since the Federal moratorium ended and the CDC policy has been put into effect, thousands of landlords have filed suits challenging the CDC authority to protect renters from eviction…Moody’s analytics forecasts that 16% of all renters will face eviction by January 2021.”

Mr. Hill’s article went on to conclude that “we forecast at least $100B in rental and mortgage debt due in January 2021.” The moratoriums and forbearance programs did not eliminate the need for mortgage and rent payments. Instead they allowed a deferral of these payments. The accumulation of past payments plus current payments will cause an enormous strain on households. Absent another stimulus program, which would likely merely kick the can down the road, the U.S. could be on the brink of a significant housing crisis. If renters do not pay their rent, then their landlords cannot pay their mortgage loans. Evictions and foreclosures are the end result. See the chart below of households by state which are not current on their rent or mortgage payments.

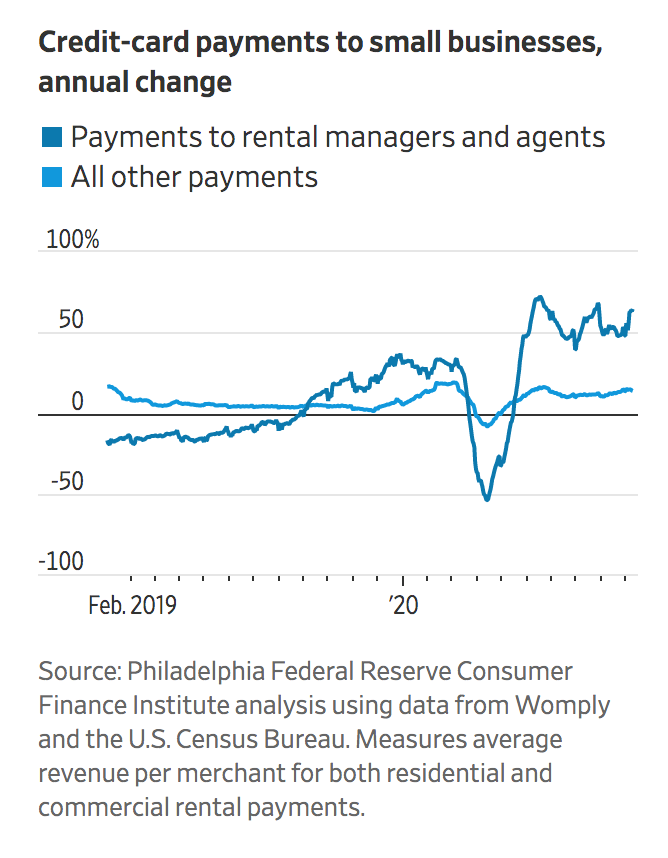

Tenants have turned to using their credit cards to pay their rent. Notice the surge in credit card payments to rental managers in the graph below.

As I have written many times before, using debt to solve a debt problem is not the answer. Due to the nature of this crisis, it is reasonable to expect the Federal Government to provide some level of additional relief. The questions remain of how much, and when. In either case it will entail the Federal Government borrowing money to provide temporary relief to taxpayers, who are likely already swimming in debt and seeing their incomes fall. The assistance will provide some short-term relief but will not provide a long-term solution.

Mortgage delinquencies, pointed out by Patrick Hill, are up by 107% for the year-to-date period through October. He wrapped up his article stating, “For investors, this is the time to prepare for a possible severe economic storm coming this winter. Scott Minerd, Global CIO at Guggenheim, observes that we have a pause now giving us time to prepare for an economic whirlwind:

‘the relative calm we feel in the markets right now isn’t the end of the storm, it is just the eye, it may seem like there is no storm at all…yet the worst is yet to come.’”

The pandemic has lasted much longer than the experts originally suggested. In fact, it seems to be getting worse. While a vaccine should provide some relief, the timing might cause further economic damage. Using the vaccine as a reason, some in Congress might decide to reduce or eliminate their support for further stimulus plans. The damage to households is building, and the safety nets are disappearing. Further stimulus will only widen the eye delaying the other side of the storm. As Scott Minerd said, we are just in the eye!

The S&P 500 Index closed at 3,638, up 2.3% for the week. The yield on the 10-year Treasury Note rose to 0.84%. Oil prices increased to $46 per barrel, and the national average price of gasoline according to AAA rose to $2.13 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.