Executive Summary

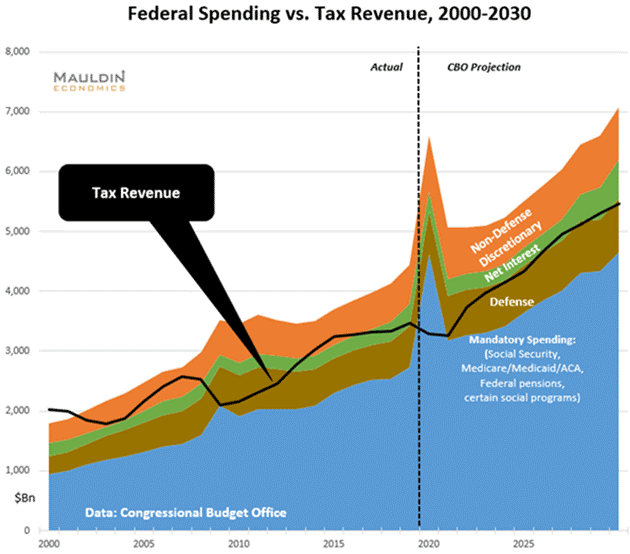

The U.S. has been feeling the effects of growing government debt for two decades through reduced economic growth. For the past 40 years Federal government debt has grown at a faster rate than the economy. The effects are cumulative and will continue to build until an eventual reset. In the first graph below, one can see Federal revenue versus Federal expenses illustrating they do not cover discretionary or interest expenses. I have included several of my own projections plus some from outside resources to illustrate how severe the debt problem could become over the next decade. For perspective, the current (calendar) year stimulus could total five trillion. If you were to spend $100,000 per day, every day, it would take almost 137,000 years to spend $5 trillion. The upcoming decade will likely include increased volatility in markets with unprecedentedly low interest rates due to slow growth. Future investing success will require being nimble and adjusting investments accordingly.

“Some debts are fun when you are acquiring them, but none are fun when you set about retiring them.”

–Ogden Nash

The Details

For decades, government debt has been compounding. Some economists say government debt doesn’t matter since the U.S. can print as much money as needed. Others believe there is a point of no return wherein once crossed an eventual reset, involving defaults and restructuring debt obligations, becomes inevitable. What cannot be determined is how much time elapses between the point of no return and the reset.

As long as the economy is growing at a faster pace than debt, the debt balance should be manageable. For the better part of the past 40 years, government debt has grown at a faster rate than the economy. The effect of these deficits is cumulative and will continue to build until the eventual reset.

Economist John Mauldin, using data from the Congressional Budget Office (CBO) created the following graph highlighting Federal revenue versus Federal expenses, broken down by category. The post-2020 projections from the CBO were based upon the situation at the time of the projections; however, they do not consider the possibility of an extended economic downturn requiring further stimulus or the possibility of a double-dip recession in the future. Notice that Federal revenues only cover mandatory and defense spending and they do not cover discretionary or interest expenses.

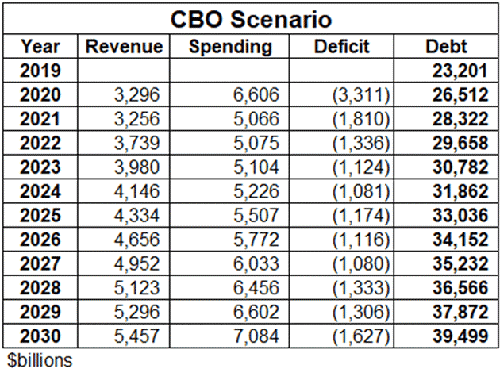

The CBO numbers shown in the chart below, also from John Mauldin, do not consider additional stimulus beyond that already in law. Currently, Congress is debating a second stimulus plan which appears likely to settle around the $2 trillion mark. Just for some perspective, during the Great Recession and Financial Crisis of 2007-2009, two stimulus bills were enacted totaling close to $940 billion. This was considered the worse Financial Crisis since the Great Depression and many shuddered at the thought of such a large amount of stimulus and additional debt. More recently, Congress hardly blinked at the thought of passing the last package, over $3 trillion. Now they are considering piling on an additional $2 trillion plus. To give you an idea of how much five trillion is, if you were to spend $100,000 per day, every day, it would take almost 137,000 years to spend $5 trillion.

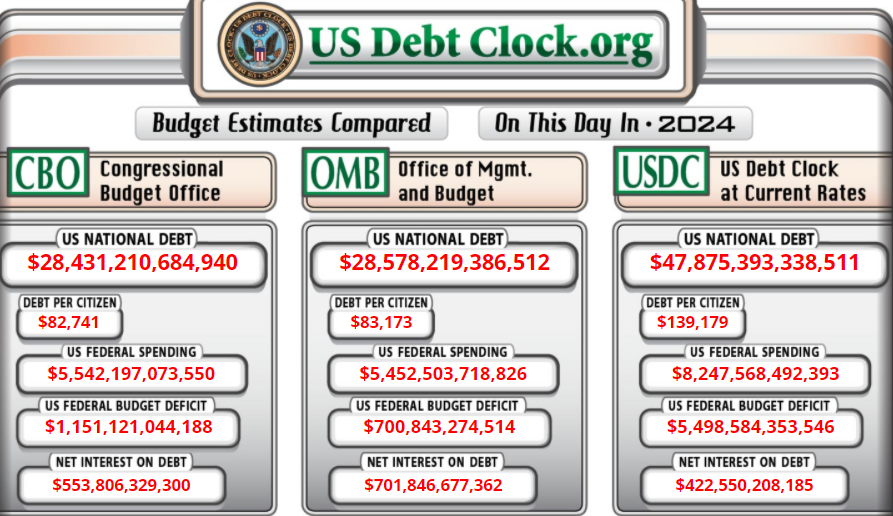

If you would like to see an up-to-date overview of the debt and deficit data, a good source is www.usdebtclock.org. I snapped the following picture of the current debt balances per this website.

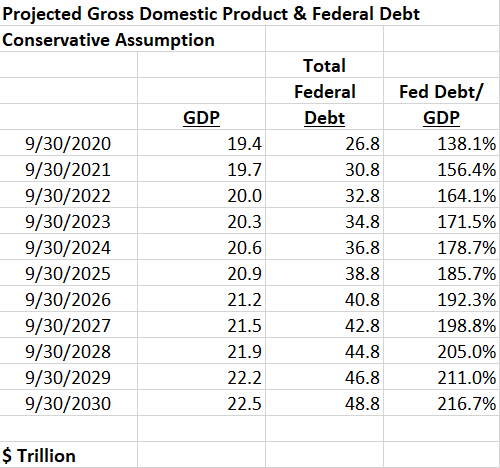

The fiscal year for the Federal government runs from October 1 through September 30. Starting with the debt balance shown above and estimating for fiscal year-end on September 30, I created the following chart. For GDP growth, I used a real (after-inflation) rate of 1.5% which might be overly aggressive considering the debt balances and state of the pandemic. For growth in Federal debt, I used the 2021 CBO deficit and added $2.2 trillion for additional stimulus. Then, I increased debt in subsequent years by an estimated annual deficit of $2 trillion. In 10 years, the debt balance would grow to almost $49 trillion and could be a staggering 217% of GDP.

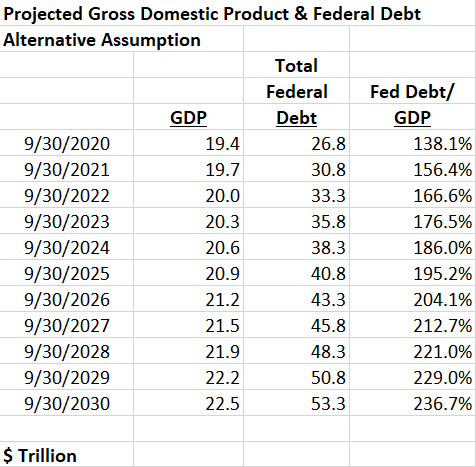

Now, assuming a prolonged recovery (as opposed to a V-shaped recovery) due to the pandemic and massive debt additions, I created an alternative scenario in which I increased the Federal debt by $2.5 trillion per year beginning in 2022. This scenario puts the debt at $53 trillion in 10 years and 237% of GDP.

Some of the reasons for increasing the deficit in future years in the alternative scenario include, but are not limited to, the following financial issues hanging over our heads. There are currently over $1.6 trillion in student loans outstanding, many of which are delinquent. Due to rent and mortgage forbearances, many future defaults will occur in the residential and commercial real estate markets. State and local governments currently maintain over $3 trillion in debt. The pandemic has put pressure on state and local revenues. A potential Federal bailout of any or all of these areas of concern is not out of the question.

On the USDebtClock.org website, you can see a comparison of debt projections for the year 2024 by the CBO, the Office of Management and Budget (OMB), and the US Debt Clock projection assuming current rates. These numbers are shown below. If the US Debt Clock projections are correct, then the debt balance could exceed $60 trillion by end of 2030.

The numbers above do not include the 800-pound gorilla, unfunded liabilities. According to USDebtClock.org, current unfunded liabilities are approximately $154.7 trillion. Until the ultimate reset, this amount of debt will pose a significant drag on future economic growth. Therefore, long-term interest rates should remain low and possibly fall further.

John Mauldin wrote in his “Thoughts From The Frontline”:

“I was explaining this to a friend last night. He asked me what we should do, somehow believing that there has to be an answer. There isn’t one. We have no good choices left. It is as if we are on a trip through a desert and know for certain we don’t have enough water to go back. We don’t know where the desert ends, but we have to go forward.

That’s the reality. Unless you want to cut Social Security and Medicare, ignore military pensions, sell the national parks, abolish departments like State and Treasury, cut the defense budget in half along with Homeland Security, Education, Labor, the Justice Department and the FBI, etc. we are going to have to live with the $2 trillion deficits. In good years. There are no better choices.”

Unfortunately, poor financial decisions over previous decades have left the U.S. past the point of no return. The pandemic only worsened an already bad situation. Debt does matter. The U.S. has been feeling the effects of it for two decades through reduced economic growth. The important thing is for investors to be aware of the situation and therefore, be prepared to invest their assets accordingly. The upcoming decade will likely include increased volatility in markets with unprecedentedly low interest rates. Being nimble and aware are critical to future investing success.

The S&P 500 Index closed at 3,299 down 0.6% for the week. The yield on the 10-year Treasury Note fell to 0.66%. Oil prices decreased to $40 per barrel, and the national average price of gasoline according to AAA rose to $2.19 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.