Executive Summary

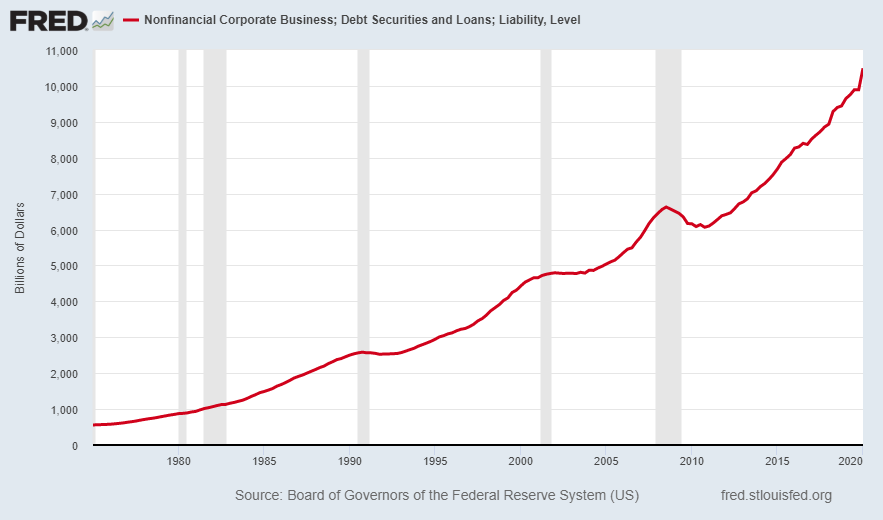

After working-off the defaults and write-offs from the Financial Crisis, debt immediately became in-vogue again. In fact, by the end of 2019 just prior to the arrival of COVID-19, non-financial corporate debt had reached record levels. But debt growth was not restricted to corporations – individual debts compounded, as massive annual Federal deficits pushed the National debt to the stratosphere. With the arrival of the pandemic came a surge in corporate debt. Hedgeye Risk Management, LLC reported in their daily missive that corporate debt has recently surged by a whopping $1.9 trillion! Debt is always the tool used to survive times of financial stress. However, debt should be reduced in “good times” to allow a cushion during tough times. Unfortunately, debt has continued its ascent for decades. I have explained in many prior newsletters how debt becomes an anchor to economic growth. The combination of weak demand and weakening global economies with soaring debt on top of prior record debt balances portends for much weaker economic growth in the coming decade.

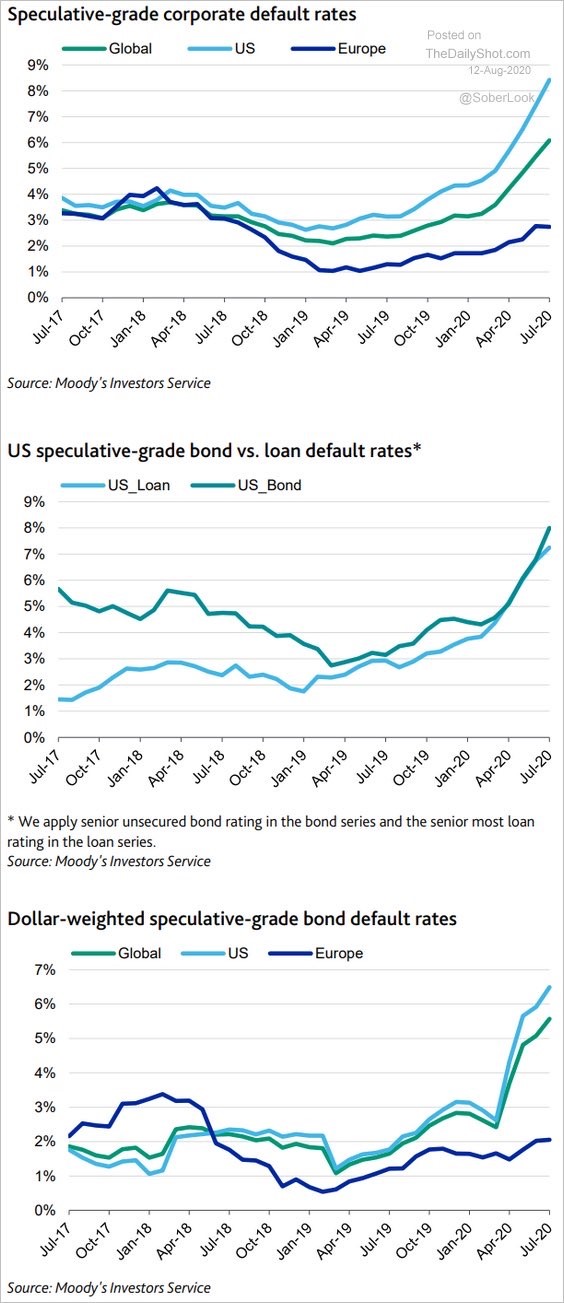

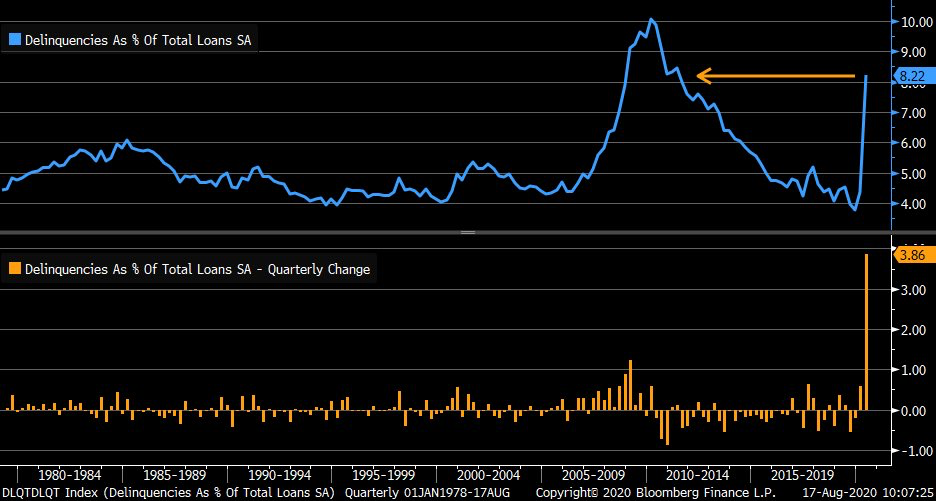

Please see the graphs in The Details below showing rising corporate default rates and mortgage delinquencies to get a better understanding of the predicament that is building.

“All men make mistakes, but only wise men learn from their mistakes.”

–Winston Churchill

The Details

After working-off the defaults and write-offs from the Financial Crisis, debt immediately became in-vogue again. In fact, by the end of 2019 just prior to the arrival of COVID-19, non-financial corporate debt had reached record levels. But debt growth was not restricted to corporations –individual debts compounded, as massive annual Federal deficits pushed the National debt to the stratosphere. With so much debt sloshing around, how would the economy deal with the major economic disruption brought about by a pandemic? By encouraging more debt, of course.

Almost all of the proposed “solutions” to the economic stoppage involved some form of additional debt. The Federal government provided stimulus payments and implemented the Paycheck Protection Program (PPP) to provide forgivable loans to businesses, funded by huge additional deficit spending. Interest rates were dropped, and programs established to provide loans to mid-size businesses and allow individuals to borrow money more cheaply.

The problem is that loan balances grow and if demand does not surge as fast or faster than the loan growth, businesses fall behind. When businesses fall behind, they are often required to lay off workers resulting in less income for consumption and servicing existing debt. As written in the article, “Implications of COVID-19 Disruption for Corporate Leverage” by the Federal Reserve Bank of New York published by Liberty Street Economics, “During a downturn, highly levered firms are at greater risk of becoming insolvent than their less-levered peers since they must continue to make interest payments on their debt even when their business may have slowed.” The amount of earnings available to pay interest on debt is called the Interest Coverage Ratio (ICR). In this article, it was noted that the ICR fell 25% from the fourth quarter 2019 through the first quarter 2020. And, it was only expected to worsen as the impact of COVID-19 spread during the second quarter. At the end of the first quarter 2020, 24.83% of all public firms had an ICR of less than one, meaning their earnings were less than their interest requirements.

With the arrival of the pandemic came a surge in corporate debt. The chart below illustrates that non-financial corporate debt was already at record highs, yet due to the pandemic, the line turned almost vertical. Hedgeye Risk Management, LLC reported in their daily missive that corporate debt has recently surged by a whopping $1.9 trillion!

Bill Blain wrote in his “The Morning Porridge” blog, “Many companies are struggling with increased debt – it’s kept them afloat, but leaves them with a massive leverage burden, which will seriously impact their ability to grow, innovate and introduce new products. Even before the crisis began, we were looking at 20% of US companies as effectively ‘zombies’ [interest cost higher than earnings].

There is a very simple equation – higher debt = lower growth.

Right across commercial enterprise companies have been forced to take on debt to weather the pandemic. This is happening at a time when a demand-shock – from massively increased unemployment – looks nailed on. The result will hamper growth for these companies and across economies, potentially for the next decade.”

Companies in many industries are struggling. If one were to look up the price-to-earnings ratio of the Russell 2000 Index (index of 2,000 small and mid-cap companies), one might be confused to see “n.a.”. The reason for the “n.a.” is the total of earnings for all companies in the index results in a loss or negative number. How can these companies service debt if they are losing money?

Notice the rise in US corporate bond and loan default rates below.

Companies are cutting costs hoping demand will return sufficient to cover overhead and debt-servicing costs. However, as the pandemic persists and PPP money gone, rent payments are being skipped. Notice the drop in rent collections in the most affordable Class C units in the graph below.

And, the pain is not limited to corporations. In the chart below, notice the recent surge in mortgage delinquencies which are back to Financial Crisis levels.

Delinquencies on FHA mortgage loans hit an astounding 15.7% in the second quarter 2020.

Debt is always the tool used to survive times of financial stress. However, debt should be reduced in “good times” to allow a cushion during tough times. Unfortunately, debt – whether corporate, Federal government, or individual – has continued its ascent for decades. The Federal Reserve Bank has been forced to drop interest rates to near zero percent as higher rates would accelerate delinquencies and ultimately defaults.

I have explained in many prior newsletters how debt becomes an anchor to economic growth. The combination of weak demand and weakening global economies with soaring debt on top of prior record debt balances portends for much weaker economic growth in the coming decade. Total debt, as shown in last week’s missive, is reaching dangerous levels as a percentage of the economy, now approaching 310%! At some point there is only one way to realign the debt balances to a reasonable percentage of GDP…significant inflation. Are we there yet? Time will tell as to how much more debt can be piled-on before a debt reset is forced upon the economy.

Debt is always the answer because it appears to be the easy way out. Unfortunately, that might not be the case this time.

The S&P 500 Index closed at 3,373 up 0.6% for the week. The yield on the 10-year Treasury Note rose to 0.71%. Oil prices increased to $42 per barrel, and the national average price of gasoline according to AAA remained at $2.18 per gallon.

© 2020. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.