Executive Summary

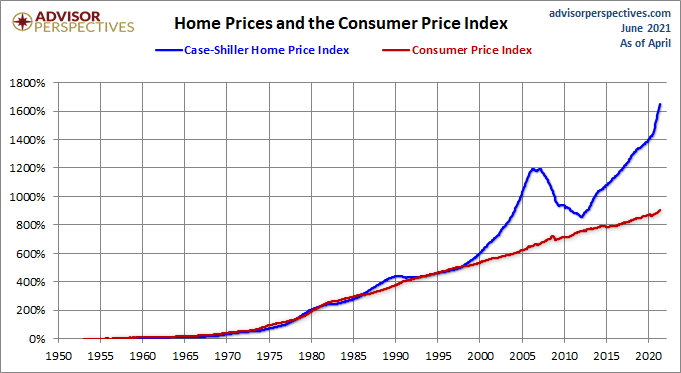

Due to low mortgage rates and depressed inventory, the housing market is red hot. Investors have scooped up existing home inventory, while new single-family home sales are off their peak (see second graph). New-home prices are very high (third graph); however, if one takes a close look they appear to be turning downward. Comparing home prices to the Consumer Price Index is an indicator of sustainability of home prices. When home prices detach from this indicator, homes become unaffordable (see fifth graph). Although it is a little early to conclude that the housing market is turning:

Please proceed to The Details for an explanation of the relationships to watch moving forward.

“Bubbles have quite a few things in common, but housing bubbles have a spectacular thing in common, and that is every one of them is considered unique and different.”

–Jeremy Grantham

The Details

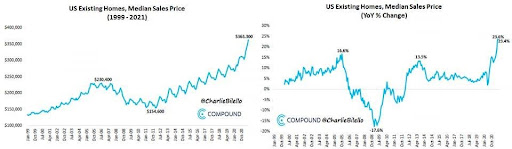

Fed by low mortgage interest rates and depressed inventory, the housing market has been red hot pushing prices higher than the 2007 peak. The lack of inventory is partly due to high investor participation, scooping up houses for rental purposes. The June rate of change in residential home prices jumped over 20% year-over-year.

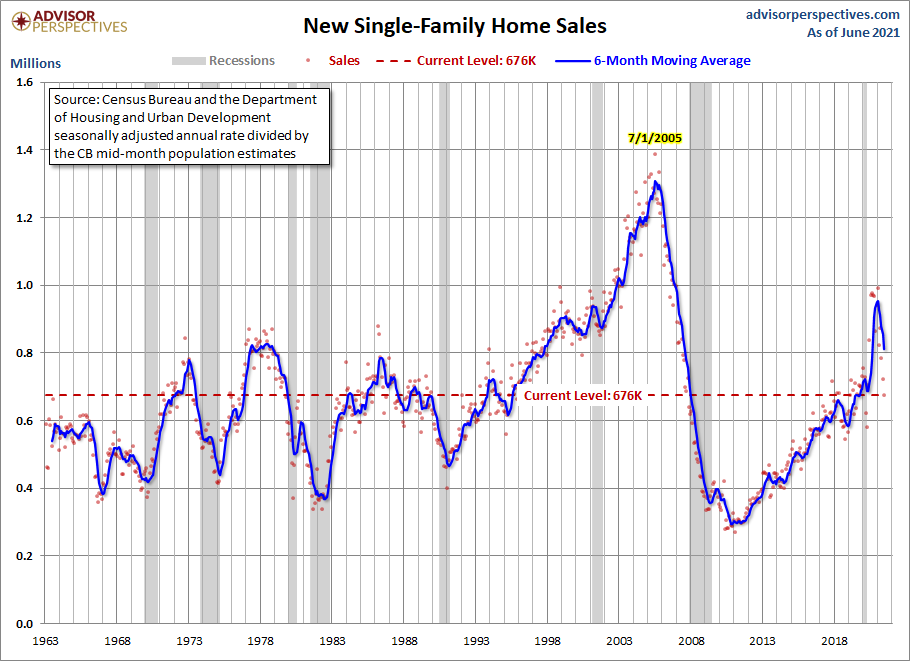

Another reason for the lack of inventory has been the low-level of new homes built. Notice in the graph below that the June level of new home sales, at 676,000 (seasonally adjusted annual rate), is far below prior peaks and significantly off the recent high. According to the Census Bureau, “This is 6.6 percent (±16.5 percent) below the revised May rate of 724,000 and is 19.4 percent (±13.9 percent) below the June 2020 estimate of 839,000.”

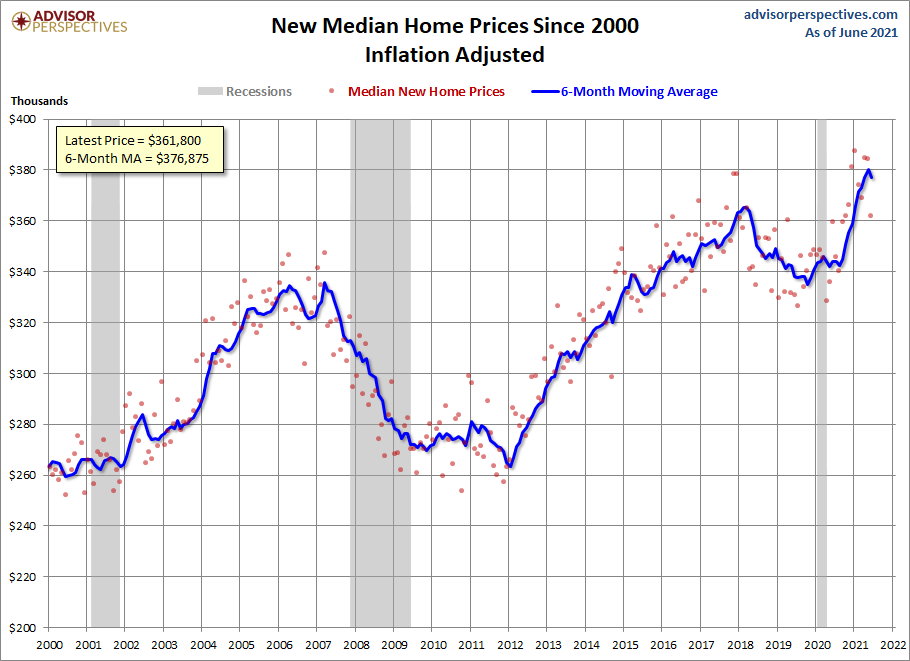

In the chart below of inflation-adjusted new home prices, notice prices recently reached an all-time high. Also note, prices appear to be turning the corner.

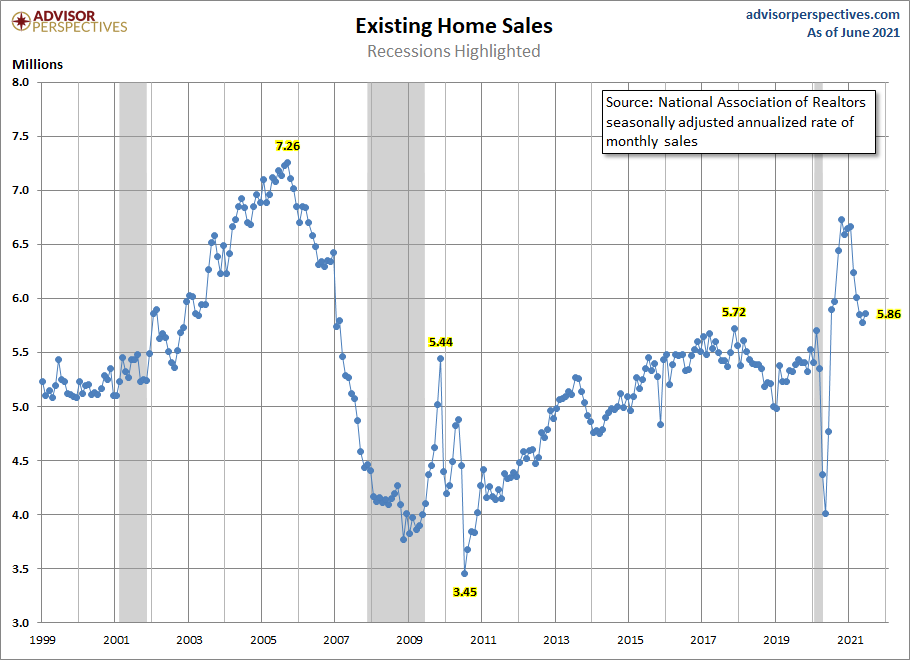

In the larger existing home market, the number of home sales shown in the graph below, at 5.86 million (seasonally adjusted annual rate), has also dropped substantially from its 2020 peak.

One of the best ways to determine the sustainability of home prices is to compare them to the Consumer Price Index (CPI). Over the long-term, prices tend to track the CPI. The current price bubble is even greater than that witnessed during real estate boom prior to 2008 and is evident in the graph below.

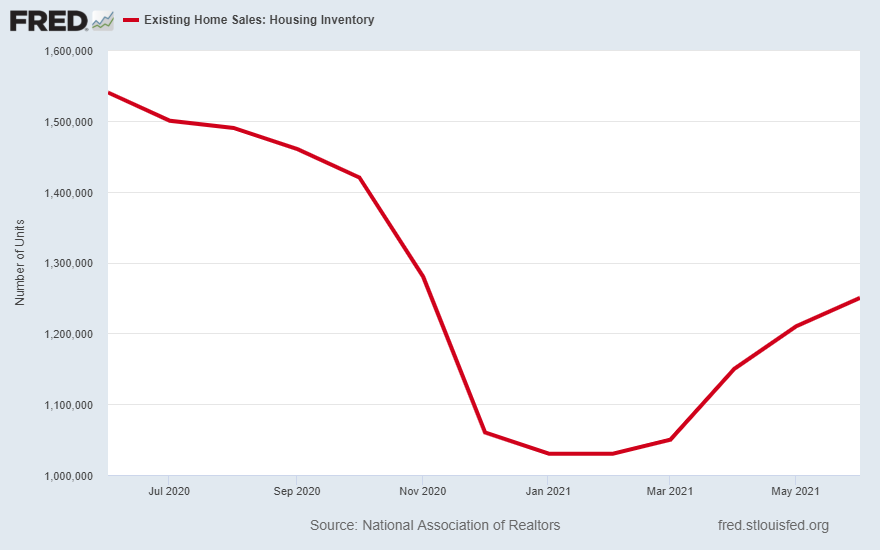

Although it is a little early to conclude that the housing market is turning, the existence of a home price bubble is quite evident. The level of sales of both new and existing homes has at least temporarily retracted from its peak. The graph below shows home inventory levels seem to have bottomed and are on the rise.

If housing inventory continues to rise and prices continue to decrease, it could indicate that the housing market is turning the corner. Home buyers today should be aware of the disconnect from historical norms and understand that better prices could become available down the road.

The S&P 500 Index closed at 4,412 up 1.96% for the week. The yield on the 10-year Treasury Note fell to 1.29%. Oil prices remained at $72 per barrel, and the national average price of gasoline according to AAA rose to $3.16 per gallon.

© 2021. This material was prepared by Bob Cremerius, CPA/PFS, of Prudent Financial, and does not necessarily represent the views of other presenting parties, nor their affiliates. This information should not be construed as investment, tax or legal advice. Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Actual results, performance or achievements may differ materially from those expressed or implied. All information is believed to be from reliable sources; however we make no representation as to its completeness or accuracy.

Securities offered through First Heartland Capital, Inc., Member FINRA & SIPC. | Advisory Services offered through First Heartland Consultants, Inc. Prudent Financial is not affiliated with First Heartland Capital, Inc.