How Does the Economy Look?

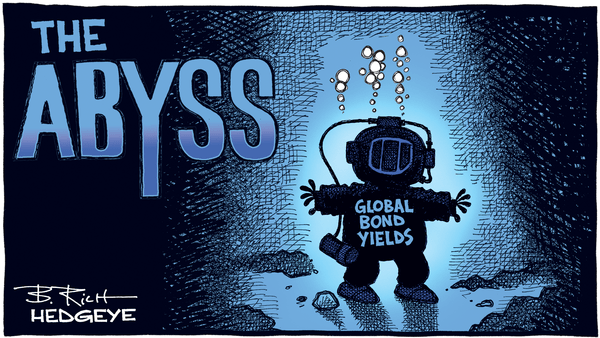

Executive Summary You may have heard the expression: “a picture is worth a thousand words”. Weekly I write much about the economy and the markets. This week I am taking a que from the above quote. Please take a look below at the charts and graphs with [...]