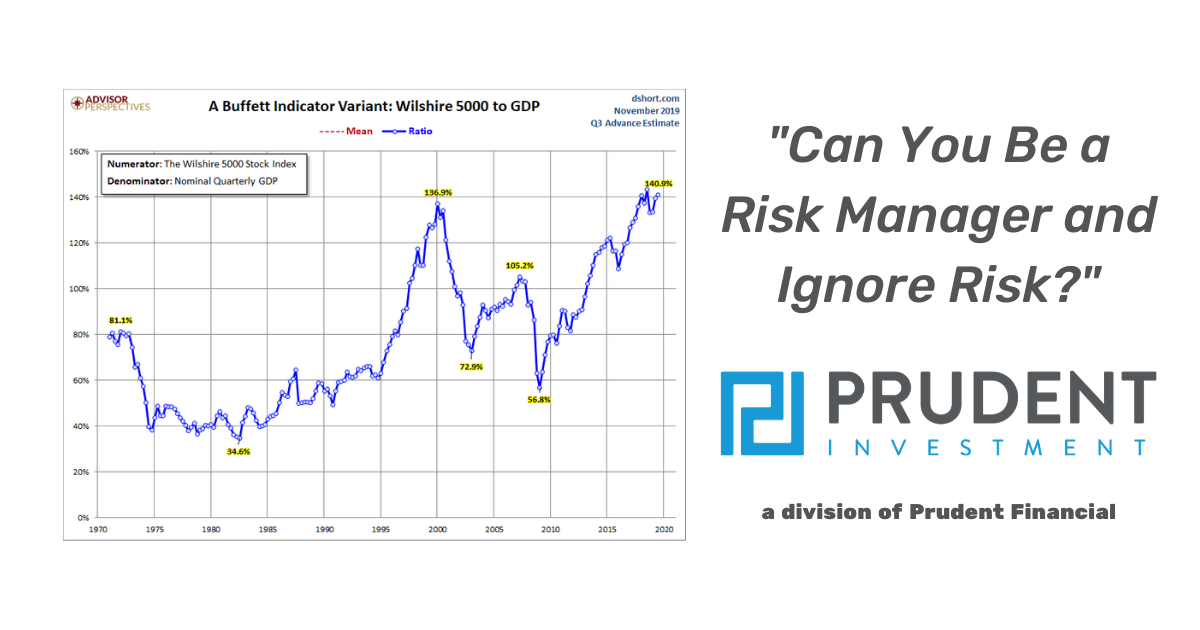

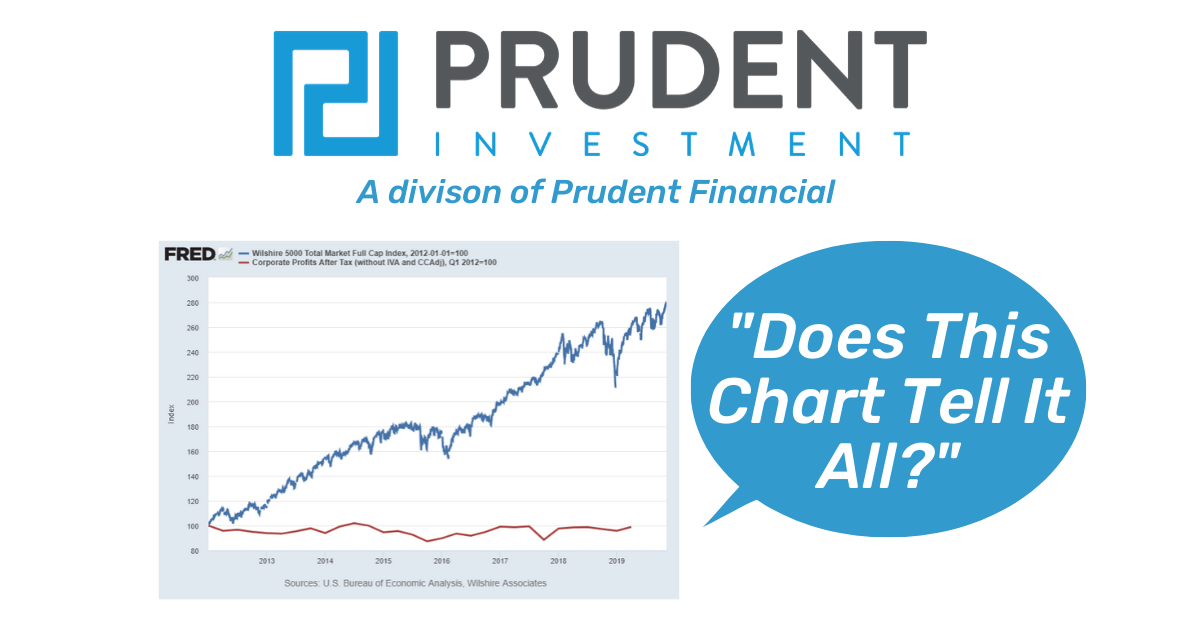

Are Stock Prices More Overvalued Now Than at the Market Peak?

Executive Summary Many investors are probably thinking the recent stock market correction brought stock valuations more in-line with their long-term average. Stock valuations are typically measured using some derivation of the price-to-earnings ratio. The trailing twelve-month price-to-earnings ratio was 24 in February. However, due to the COVID-19 [...]